A Wall Street analyst supports a statement indicating that XRP is one of the best chances for investors to create generational wealth.

This view was initially expressed by Digital G, a market commentator, amid the ongoing market volatility. For reference, XRP has been adversely affected by the recent market downturn, which eliminated more than $1.7 billion in leveraged positions from approximately 584,000 traders.

Data indicates that XRP experienced one of the most severe selloff trends for any cryptocurrency, particularly on Coinbase. This resulted in a significant 14.87% price drop on Monday, with the altcoin closing at the lower end of the $2 price range.

XRP Constitutes an Opportunity for Generational Wealth

In the midst of these challenges, XRP has demonstrated remarkable resilience, which has fostered optimism about its future. With confidence in its potential remaining strong, Digital G, who was a regulated fund manager in the U.K., recently emphasized the significance of investing in XRP.

He acknowledged that XRP offers one of the best opportunities for any investor to achieve generational wealth. Furthermore, he believes that two other cryptocurrencies with similar potential are Stellar (XLM), a competitor to XRP, and XDC Network (XDC).

Interestingly, Wall Street analyst Linda P. Jones, an outspoken supporter of XRP, concurred with this view. She mentioned that she wrote a book on these assets and how such investments can lead to life-changing wealth for investors. The wealth mentor likely referred to her bestselling work “3 Steps to Quantum Wealth.”

Notably, all three cryptocurrencies aim to assist retail and institutional users in facilitating efficient cross-border payments and financial transactions by offering fast, cost-effective, and scalable solutions for transferring value.

Potential of XRP, XLM, and XDC

Digital G’s perspective may stem from the fact that these cryptocurrencies, particularly XRP, possess ecosystems designed to address real-world financial challenges, like remittances and settlements, and have established partnerships with banks, governments, and corporations.

While they have underperformed in earlier years, their recent price movements indicate growth potential. For example, XRP has increased by over 303% since November, while XLM has surged by 448%. Additionally, XDC has risen by 175% in the same period.

Consequently, various market analysts have set ambitious targets for these tokens. Recently, market analyst EGRAG suggested that XRP was mirroring Tesla’s performance in 2018, predicting a 50% decline followed by a 3,500% increase beyond $40.

Moreover, last month, Charting Guy, a market commentator, highlighted a bullish price pattern on the 1-month XLM chart, which he believes could trigger a rise to $5. Earlier in the month, Javon Marks established a breakout target of $0.1814 for XDC.

What Is Ripple (XRP)?

Ripple is a digital payment network and protocol that was introduced in 2012 by Chris Larsen and Jed McCaleb. The network utilizes XRP as its native cryptocurrency to facilitate quick, low-cost international money transfers and currency exchanges. Ripple is focused on serving banks and financial institutions by replacing traditional cross-border payment systems, such as SWIFT.

XRP distinguishes itself from other cryptocurrencies through its distinctive consensus mechanism and business model. While the majority of cryptocurrencies rely on mining for transaction validation, XRP coins were pre-mined at launch, with a total of 100 billion tokens created. Ripple Labs holds around 48 billion XRP in escrow, releasing up to 1 billion tokens monthly to manage supply and uphold price stability.

How Does Ripple (XRP) Work?

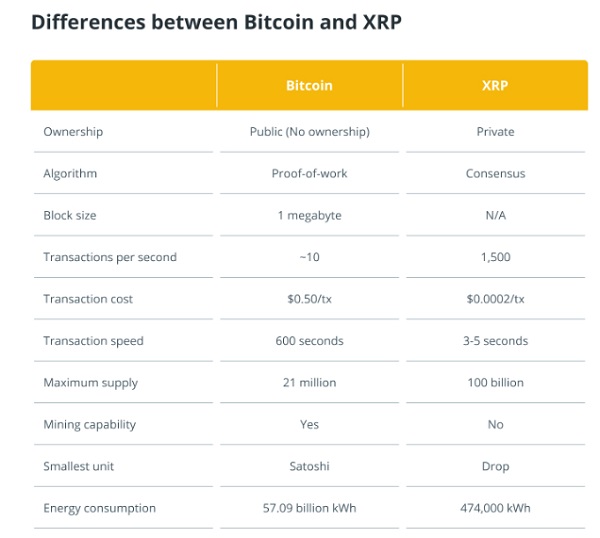

The Ripple network processes transactions via the Ripple Protocol Consensus Algorithm, which validates transactions by having designated servers compare transaction records until they achieve a supermajority agreement. This method enables XRP to process transactions in 3-5 seconds and handle up to 1,500 transactions per second, making it considerably faster than conventional blockchain networks.

When banks utilize Ripple for cross-border payments, they can either employ XRP as a bridge currency or use Ripple’s messaging system to enhance their current currency transfers. For instance, if Bank A intends to send dollars to Bank B in euros, the network can automatically select the most cost-effective route, whether through direct currency exchange or by using XRP as an intermediary. This flexibility allows banks to minimize their transaction expenses while retaining control over their operations.

Key Features Of Ripple

Ripple’s architecture offers three primary advantages for global transactions: speed, cost-effectiveness, and scalability. These characteristics render it a compelling alternative to conventional banking systems and other cryptocurrencies, especially for financial institutions dealing with substantial volumes of cross-border payments.

Speed And Efficiency

Ripple completes transactions in 3-5 seconds through its consensus mechanism, compared to Bitcoin’s 10-minute block time or traditional banking systems, which can take days. This speed is attributable to XRP’s unique validation process, which eliminates the need for mining. The network has the capacity to settle over 1,500 transactions per second.

Low Transaction Costs

XRP transactions average around 0.00001 XRP (just a fraction of a cent), which is significantly less than Bitcoin’s transaction fees or the traditional costs of wire transfers that can reach between $25 and $50. Banks utilizing RippleNet for international payments can reduce operational expenses by up to 60%, eliminating the necessity for pre-funding nostro accounts in the countries they transact with.

Scalability

The XRP Ledger is capable of handling 1,500 transactions per second continuously and has the potential to scale up to 50,000 TPS through further optimizations. Unlike blockchain networks that become larger with each transaction, Ripple’s ledger remains effective by pruning older transactions while preserving their cryptographic integrity. This structure avoids network congestion and ensures consistent performance, even as usage increases.

Pros And Cons Of Ripple (XRP)

RippleNet and XRP display unique technical characteristics, operational functionalities, and limitations within the blockchain payment infrastructure. Let’s explore the main points of this technology.

Pros Of XRP

Established financial institutions are utilizing RippleNet for international payments, which demonstrates the technology’s practical utility and adoption. XRP transactions require significantly less energy compared to Bitcoin and Ethereum, with the network consuming roughly the same amount of energy annually as 50 U.S. households. RippleNet helps banks reduce operational costs by eliminating intermediary fees and the need for pre-funding foreign accounts, allowing banks to save up to 60% on international transfer expenses.

Cons of XRP

The ongoing SEC lawsuit against Ripple Labs creates uncertainty regarding XRP’s classification as a security. This impacts XRP trading options in the U.S. and influences its price stability. Ripple Labs holds around 48 billion XRP in escrow, and this level of control over such a significant portion of the tokens contradicts the decentralization principles inherent in cryptocurrencies. Additionally, many banks using RippleNet leverage Ripple’s technology without actually utilizing XRP tokens, which restricts XRP’s use and potential demand arising from institutional adoption.

How Can Ripple Be Used?

RippleNet operates as a payment network for financial institutions, while XRP acts as a bridge currency for cross-border transactions. Users have the option to send XRP directly to other wallet addresses for almost instant settlements or to trade it on cryptocurrency exchanges. The XRP Ledger also accommodates custom tokens and smart contracts for the development of decentralized applications.

Companies and developers can create payment solutions on the XRP Ledger by using its open-source protocol. The network offers features such as payment streaming, escrow mechanisms, and multi-signature wallets. These tools empower businesses to establish automated payment systems, arrange recurring transfers, or innovate financial products.

Where Do You Buy Ripple (XRP)?

Major cryptocurrency exchanges such as Binance, Kraken, and Bitstamp offer trading pairs for XRP against various cryptocurrencies and fiat currencies. Users must create an account, undergo identity verification, and deposit funds to begin trading.

To store XRP, users can opt for software wallets like XUMM, hardware wallets like Ledger or Trezor, or keep their tokens on exchanges. Each wallet necessitates a minimum deposit of 10 XRP to activate the address and help maintain the stability of the network.

Ripple’s Risks And Challenges

The SEC lawsuit against Ripple Labs raises questions about whether XRP sales were unregistered securities offerings. This legal conflict has resulted in uncertainty surrounding XRP’s regulatory status and constrained its availability within the U.S. market. The outcome could have implications for the classification and regulation of digital assets.

Competition from other blockchain payment solutions and central bank digital currencies presents challenges to Ripple’s market positioning. Improvements to SWIFT’s payment system and emerging blockchain networks provide alternative methods for cross-border transactions.

The concentration of XRP tokens owned by Ripple Labs leads to concerns regarding centralization and price volatility. Monthly releases from the escrow could influence market supply, while adoption levels among RippleNet participants impact the long-term utility of the token.

Ripple’s Future

Ripple Labs continues to broaden the reach of RippleNet through partnerships with banks and financial institutions globally. The organization is concentrating on emerging markets in Asia and Latin America, where the traditional banking systems are inefficient. These areas represent significant growth opportunities for faster and more affordable cross-border payments.

The rise of central bank digital currencies (CBDCs) presents new avenues for Ripple’s technology. The XRP Ledger offers an established infrastructure for the implementation and interoperability of CBDCs. Several central banks are examining the platform for potential pilots and applications of CBDCs.

Ripple’s initiatives in tokenization and smart contracts aim to diversify its functionalities beyond payment processing. The company is developing capabilities for NFTs, DeFi applications, and institutional asset trading on the XRP Ledger, thereby expanding the network’s role within the digital asset ecosystem.

Bottom Line

Ripple’s payment system and XRP cryptocurrency provide an alternative to the conventional banking system for international transactions. This technology blends speed, affordability, and scalability with increasing adoption by institutions.

RippleNet encounters regulatory hurdles and competition, yet it continues to advance through new collaborations, central bank digital currency (CBDC) projects, and enhanced blockchain functionalities. The platform’s success hinges on clear regulations, institutional adoption, and its capability to preserve technical advantages in the digital payments arena.

What is the difference between Ripple and Bitcoin?

Bitcoin was the first cryptocurrency to issue a white paper in 2009, proposing a novel form of currency. As this concept gained traction to become the first practical application of blockchain technology, Bitcoin found roles within the internet and eventually established borderless marketplaces.

The infrastructure of Bitcoin’s blockchain operates through a network of independent node operators and miners distributed globally. The Bitcoin white paper, referred to as “Bitcoin: A Peer-to-Peer Electronic Cash System,” initiated the concept of decentralized finance (DeFi) under the aim of returning power to individuals, but the technology also needed to outclass the traditional financial system in various aspects. This required being quicker, more secure, limited in quantity, and boundless in geography, among other essential characteristics of an asset recognized as money.

As entrepreneurs embraced this challenge, it led to the emergence of multiple sub-cryptosystems that would ultimately compete to dethrone Bitcoin as the leader in cryptocurrency. This is where Ripple’s XRP comes in, a cryptocurrency or altcoin inspired by Bitcoin but aimed at enhancing the traditional financial system.

The Ripple network utilizes XRP to facilitate cross-border transactions for both businesses and individuals. Ripple achieves this by collaborating with financial institutions like banks to establish payment corridors while adhering to local regulations.

However, the distinctions between XRP and Bitcoin deepen from this point forth.

Inception — The rise of the duel

The anonymous founder(s) of Bitcoin chose to use the pseudonym Satoshi Nakamoto. They succeeded in this endeavor, as all the clues and claims collected over the last decade have led to a standstill. The aim behind this choice was to create a genuinely decentralized peer-to-peer (P2P) financial ecosystem free from oversight. By lacking any formal establishment, Bitcoin has endured various forms of regulatory examination and opposition while making strides toward mainstream acceptance.

The XRP Ledger (XRPL) was developed in 2011 by engineers seeking to create a superior version of Bitcoin. The team—David Schwartz, Jed McCaleb, and Arthur Britto—envisioned a Bitcoin-like framework that did not rely on mining processes, with Chris Larsen completing the team. With this ambition, the ledger initially introduced Ripples or XRP as its native token. Since then, XRP has emerged as the preferred cryptocurrency for traditional institutions worldwide interested in cross-border remittance efforts.

Looking past the differences in their origins, both Bitcoin and XRP benefit from their communities of crypto supporters who advocate for their respective ecosystems on a global scale. Both communities are currently striving to achieve legal recognition for their cryptocurrencies, but unlike XRP, Bitcoin does not have backing from any institutions like Ripple and its legal team.

The advocacy for Bitcoin’s significance is entirely driven by those who genuinely believe in it and the promise of significant returns on investment. In contrast, the supporters of XRP are testing its legality within the traditional framework and heavily depend on its acceptance by banks and established financial institutions for broader adoption.

Fork the system

While Bitcoin was created to exclude banks and governments from the picture entirely, XRP adopted a different strategy to integrate within the existing financial framework. As it aligned with Ripple’s fundamental goal of enhancing cross-border payments and redefining traditional banking, XRP became a crucial piece of technology to realize this vision. Nonetheless, Ripple operates as a software company that functions independently of XRP and does not control or manage the cryptocurrency.

In opposition to Bitcoin’s open structure that is solely supported by the public, XRP is built on the privately owned interledger protocol (ILP). Bitcoin was conceived under the belief that a genuine asset that appreciates over time must have a limited supply. Thus, its issuance is capped at 21 million, although protocol changes could allow for further issuance. Utilizing the SHA-256 hash function, the Bitcoin ecosystem relies on miners to validate transactions and introduce new tokens into circulation by earning rewards.

Conversely, XRP was created without the capability to be mined, and it has a maximum supply limit of 100 billion, with 80 billion XRP initially allocated to Ripple by its founders. Nonetheless, the actual availability of XRP is influenced by the cryptocurrency’s applications, and any surplus tokens are transferred to an escrow account for future circulation. This arrangement enables XRP to facilitate more transactions in a quicker and more cost-effective manner.

The Bitcoin network heavily relies on a group of miners to sustain its ecosystem. The effectiveness of this system is founded on the trust of at least 51% of miners to counteract malicious entities and verify transactions. XRP eliminates this reliance by substituting miners with validators, which are designated servers that confirm transactions based on adherence to the protocol.

Bitcoin utilizes a proof-of-work (PoW) system to address the problem of double-spending, which, if not managed, would allow users to deceive the system into using the same Bitcoin for multiple transactions. In essence, the network relies on the good intentions of at least 51% of miners to authenticate a transaction on the Bitcoin network. While the PoW system restricts transaction speed, XRP transactions are validated and completed more rapidly by the ledger’s consensus protocol, taking approximately three to five seconds, compared to Bitcoin’s 500 seconds. This variation in protocol allows XRP to handle 1,500 transactions each second, whereas Bitcoin can process three transactions in the same interval.

Mining activities contribute significantly to energy use in the form of electricity. With a focus on long-term sustainability, XRP’s distributed consensus mechanism can validate transactions using minimal energy and a fraction of the time required by Bitcoin. However, both cryptocurrency systems necessitate a fee for transaction processing, which largely depends on the method and amount of transfer.

Regarding price fluctuations versus adoption rates, many entrepreneurs and conventional investors have shifted their perspectives since the phenomenon of the “Bitcoin billionaire” emerged. Although the original Bitcoin white paper made no such guarantees, BTC remains the most lucrative store of value that continues to draw in investors. In contrast, XRP functions as a bridge currency, surpassing fiat currency in speed and cost efficiency. XRP currently dominates the cross-border remittance market, thanks to Ripple’s vast collaborations with major banking institutions worldwide.

The XRP ecosystem primarily aims to boost its adoption rate by catering to various traditional payment use cases. The XRPL founders originally allocated 80 billion XRP to Ripple, of which 55 billion—equivalent to 55% of the total XRP supply—has been secured in a series of escrows.

Given the popularity of both XRP and Bitcoin, these cryptocurrencies can be traded on all major cryptocurrency exchanges worldwide and are generally supported by most crypto wallets. While both are cryptocurrencies at their core, Bitcoin and XRP were created to address different financial realities and aim to redefine the concept of money in the process.

What benefits do these cryptocurrencies offer to individuals? One significant challenge a crypto investor might face is deciding between the two coins or projects. However, both XRP and Bitcoin were designed for distinct purposes and do not directly compete.

Bitcoin is more accessible, allowing anyone to trade or transport Bitcoin globally, irrespective of jurisdiction. XRP functions more like a specialized instrument aimed at settling cross-border transactions efficiently and at a lower cost compared to traditional fiat currency.

As a genuine store of value, Bitcoin’s capacity for open trading provides the public with greater control over any imposed regulations and market forecasts. Conversely, XRP’s use is closely tied to Ripple’s affiliations with banking entities and has not concentrated on price fluctuations.

As XRP continues to fulfill practical applications, its significance in the financial sector is becoming increasingly recognized by banks, as it might be integrated into a streamlined system for cross-border settlements. Joint efforts from Ripple and the XRP community are working to advance Ripple’s payment solutions toward global acceptance.

On the other hand, Bitcoin’s price volatility has made it an attractive option for speculative investments. While BTC has been recognized as an asset following a decade of impressive price performance, XRP’s precise status remains ambiguous in many regions worldwide.