“Individuals who are looking for an alternative vision are encouraged to establish their own organizations,” Buterin stated in a social media update on January 18.

Vitalik Buterin, co-founder of Ethereum, revealed significant changes to the leadership of the Ethereum Foundation to prioritize technical skills and enhance communication between the foundation and developers within the Ethereum ecosystem.

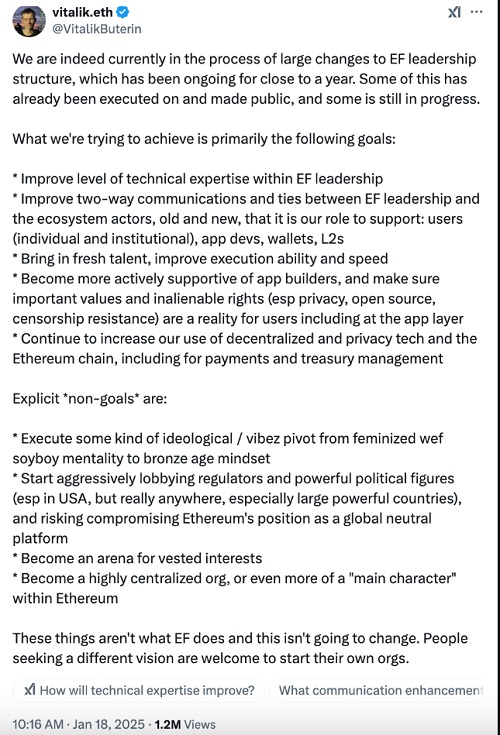

In a January 18 post on X, Buterin outlined multiple objectives for the reorganization, which included supporting developers of decentralized applications and advocating for decentralization, resistance to censorship, and privacy.

The Ethereum co-founder also mentioned that the Ethereum Foundation would refrain from engaging in political lobbying, ideological transformations, or taking on a more dominant role in the development of the Ethereum ecosystem.

This shift in leadership at the Ethereum Foundation follows a tumultuous year in 2024, during which the Foundation faced criticism regarding its spending, roadmap objectives, and staffing from the Ethereum community.

The year 2024 has left the Ethereum community uncertain.

In May 2024, the Ethereum Foundation implemented a conflict of interest policy after several prominent researchers at the Foundation accepted paid advisory roles at the EigenLayer Foundation—the organization responsible for overseeing the development of the restaking protocol.

Longtime Ethereum Foundation researcher Justin Drake took a paid advisory role at the EigenLayer Foundation in May 2024, followed by Dankrad Feist.

At that time, Drake stated he aimed to guide the EigenLayer Foundation and examine potential issues associated with restaking.

Drake resigned from the advisory role in November 2024 and issued an apology to the Ethereum community, vowing not to accept any advisory positions, angel investments, or security council roles again.

After the Dencun upgrade was launched in March 2024, transaction fees for Ethereum’s layer-2 networks saw a decrease of up to 99%.

This significant drop in layer-2 fees led to a surge in the number of Ethereum layer-2 networks. According to L2Beat, there are currently 55 Ethereum layer-2 rollups.

The rapid expansion of layer-2 networks sparked concerns among market participants, who voiced worries that these networks were undermining revenue on the base layer.

Data from Token Terminal indicated that network revenues on the Ethereum base layer plummeted by 99% in the summer of 2024 but later recovered to pre-Dencun levels by year-end.

In a recent communication, Vitalik Buterin elaborated on several goals for this restructuring. He stressed the necessity of aiding developers of decentralized applications and promoting decentralization, censorship resistance, and privacy. Buterin also made it clear that the Ethereum Foundation would not partake in political lobbying or ideological shifts, nor would it adopt a more centralized role in the Ethereum ecosystem’s development.

He further noted that the Ethereum Foundation would not aim to exert strong influence over regulators, as this might jeopardize Ethereum’s status as a globally neutral platform. He encouraged individuals with differing visions to start their own organizations.

These modifications follow a challenging year in 2024, which was characterized by scrutiny of the foundation’s expenditure, roadmap goals, and personnel. In May 2024, the Ethereum Foundation introduced a conflict of interest policy in response to several prominent researchers accepting paid advisory roles at the EigenLayer Foundation.

What effects might this have on the price of ETH?

The recent leadership changes revealed by Vitalik Buterin at the Ethereum Foundation may affect the price of ETH. By reinforcing technical proficiency and fostering better communication with the ecosystem, these adjustments aim to boost investor and user confidence. Nonetheless, the actual effect on the price will mainly rely on market perception and the effective execution of these changes.

Vitalik Buterin’s reforms at the Ethereum Foundation are designed to build trust and efficiency within the ecosystem. While the impact on the price of ETH remains uncertain, these alterations could potentially enhance market perception and promote sustainable long-term growth.

Ethereum Investors Eye $4,000 Amid Strong Institutional Confidence

Ethereum is positioning itself as a key player in a thriving crypto market. The open interest for its futures has hit an all-time high of 9 million ETH, indicating an increasing desire from institutional investors. This trend is bolstered by encouraging signals, particularly a revival of confidence among traders and a more positive economic outlook following a decrease in inflation. In this scenario, a question emerges: is ETH nearing the significant $4000 threshold, despite the challenges of volatility and global uncertainties?

Unprecedented institutional interest: figures that fascinate the market.

Recent statistics highlight notable enthusiasm for Ethereum futures, with open interest reaching a peak of 9 million ETH on January 17. This number, the highest ever seen, represents the strengthening of positions on major platforms like Binance, Bybit, and Gate.io, which collectively account for 54% of the market. In this context, the Chicago Mercantile Exchange (CME), often seen as a critical indicator of institutional interest, also maintains a significant role with a 10% market share, valued at $3.2 billion.

This trend indicates a rising confidence among Ethereum investors, albeit still cautious. The annualized premium of monthly futures has climbed to 12%, having hovered around 10% in the preceding days. This uptick suggests a newfound optimism, driven by expectations of an impending market recovery. Furthermore, an analysis of options reveals a positive sentiment, with a slight edge of call options over put options. This data reflects a balanced outlook, indicating that market participants are contemplating favorable outcomes for Ethereum.

A favorable macroeconomic backdrop

The increasing institutional interest in Ethereum coincides with a notably supportive macroeconomic landscape. In the U.S., the slowdown in inflation has bolstered expectations of a more accommodating monetary policy for 2025, creating a conducive environment for risk assets like cryptocurrencies. This scenario could prompt investors to broaden their portfolios and incorporate more cryptocurrencies, thereby minimizing the opportunity costs related to these investments. In this context, the heightened involvement of firms such as World Liberty Financial, which expanded its Ethereum holdings in December, adds a new institutional aspect to the marketplace.

Despite a notable 11% decrease in Ethereum’s price over the past month, long-term indicators remain favorable. The robust fundamentals of the Ethereum blockchain, along with a resurgence of confidence from professional traders, point to a potential rebound towards the $4000 target. Nonetheless, this path will hinge on several factors, particularly the market’s capacity to handle demand fluctuations and navigate heightened volatility. While some analysts advise caution, others emphasize that current circumstances could create a fertile environment for a significant recovery.

Ethereum is in a pivotal phase, where institutional optimism merges with beneficial macroeconomic conditions. Although targeting $4000 is ambitious, prevailing data—such as the record rise in open interest and rekindled investor confidence—hint at a possible short-term recovery. However, this advancement will depend on Ethereum’s resilience against ongoing volatility and growing expectations. In a situation where institutional players have a crucial impact, the trajectory of Ethereum could reshape its valuation and also affect the entire cryptocurrency market.

The uptake of cryptocurrency among young individuals is surging. For a lot of them, Bitcoin and Ethereum serve not merely as speculative investments, but as viable alternatives for retirement planning. Disillusioned with conventional systems, these generations lean towards modern tools that offer enhanced control and transparency. Emphasize this transformative mental shift and the motivations driving Gen Z toward decentralized solutions.

Gen Z is revolutionizing retirement through cryptocurrency. With 20% of Gen Z being the demographic most affected by crypto scams, and Alphas poised to receive pensions in cryptocurrency, as per Bitget Research, a financial transformation is in progress. This statistic highlights a generational shift: young people are no longer swayed by outdated strategies.

Why comply with a dictated retirement when Bitcoin provides adaptability and growth potential? Gracy Chen, the CEO of Bitget, asserts, “Young people seek contemporary solutions, not one-size-fits-all systems.”

The statistics are compelling:

- 40% of young individuals have ventured into cryptocurrency investments;

- 78% favor alternative methods for their savings;

- The market for altcoins and major cryptocurrencies continues to draw new investors.

- In spite of the excitement, three significant challenges impede wider adoption: market volatility, regulatory ambiguity, and cybercrime.

Yet, as Fred Krueger notes on X, “10 BTC today may be sufficient to ensure a comfortable retirement.”

What makes unconventional saving appealing to the youth? Traditional pension schemes find it difficult to persuade. With unpredictable returns and limited flexibility, they fail to ignite inspiration. Conversely, cryptocurrencies present a compelling alternative. Furthermore, decentralized finance (DeFi) boasts potential returns that surpass those of standard banking products.

Nevertheless, the narrative is not without obstacles. In 2024, hackers pilfered more than $2.3 billion in cryptocurrency. Security vulnerabilities continue to pose a serious challenge. Thankfully, innovations such as off-chain validation significantly decrease hacking risks.

And how do altcoins fit in, often seen as the gateway to diversified investment portfolios? Ethereum, Solana, and other digital currencies appeal to young people who look beyond Bitcoin. For them, cryptocurrency is not merely a gamble; it’s a strategic approach.

What does the future hold for crypto and Gen Z concerning widespread adoption? The embrace of cryptocurrency isn’t exclusive to youth. Financial institutions are also joining the trend, encouraged by clearer regulations and historic valuations.

For Gen Z, cryptocurrencies signify much more than just financial assets; they represent a new economic ideology. Decentralization, transparency, and independence are the core principles.

This generation has no plans to halt its progress. Their objective? To create a financial future where their retirement savings are influenced more by their decisions than by government regulations.

Despite the obstacles, the excitement is tangible. For instance, Bitcoin retirement initiatives are increasingly appealing, with projected savings models reaching several million over a span of two decades.

In August, Bitpanda and YouGov indicated that the adoption of cryptocurrency is rapidly increasing among younger Europeans: 32% of Millennials and 29% of Generation Z are already on board. This transformation is reshaping the continent’s financial landscape.

In recent years, Bitcoin and various other cryptocurrencies have rapidly emerged as a prominent asset class with a market capitalization in the trillions. Consequently, numerous individuals (particularly younger generations) are looking for ways to invest in cryptocurrency through their retirement accounts.

A recent survey conducted by Investopedia found that nearly 25% of millennials are now utilizing cryptocurrency to assist in achieving their retirement objectives.

If you are considering incorporating cryptocurrency into your conventional retirement or brokerage accounts, our partner Grayscale provides a diverse range of options. Grayscale’s funds offer a hassle-free method to gain access to cryptocurrency for both individual and institutional investors. For instance, as of March 2022, Morgan Stanley reported holding $458 million in the Grayscale Bitcoin Trust fund.

One of the most widely-used vehicles for retirement savings is the IRA. Depending on your individual circumstances, traditional or Roth IRAs can facilitate building your retirement savings in a tax-advantaged manner. (To find out more about each, refer to our detailed guide on retirement savings.)

If you’re looking for ways to incorporate cryptocurrency exposure into your IRA, Grayscale’s funds encompass a range of popular and emerging cryptocurrencies. Numerous Grayscale funds feature publicly-listed ticker symbols that can be looked up in brokerage accounts such as Schwab and Fidelity, or robo-advisors like Wealthfront, and subsequently added to your IRA portfolio. Others are accessible as private placements only for accredited investors, which can also be acquired through various IRA providers.

The Grayscale Bitcoin Trust, trading under the ticker GBTC, is by far the most favored, boasting a market capitalization exceeding $20 billion as of April 2022. Other options include the Grayscale Ethereum Trust (ETHE), Grayscale Litecoin Trust (LTCN), and Grayscale Digital Large Cap Fund (GDLC), which provides investors diversified exposure to some of the largest cryptocurrencies by market capitalization. Grayscale also consistently expands its product lineup with more cryptocurrency funds and offers products linked to the metaverse, DeFi, and smart contract platforms, among others.

If you’re eager to gain direct exposure to cryptocurrency in your IRA or standard brokerage account, simply enter the Grayscale ticker symbol into your account or reach out to your chosen financial services provider. Additionally, we suggest consulting a registered financial advisor regarding the addition of cryptocurrency to your retirement portfolio.

Typically, pension funds are seen as conservative, indicating they usually have a low-risk tolerance. However, cautious investors have recently opted to test the waters with Bitcoin due to its impressive growth in the past few years. According to the Financial Times, two pension schemes from Wisconsin and Michigan have become significant holders of cryptocurrency-based US stock market funds.

Those investments would subsequently be reinvested into a regulated US exchange-traded fund, which monitored the price movements of well-known cryptocurrencies like Bitcoin and Ethereum.

Several conservative fund managers have come to the realization that Bitcoin prices could reach new heights, potentially approaching $100,000 per unit in 2023.

Record-Setting Bitcoin Performance Attracts Pension Funds

This impressive performance has been linked to an increasing interest in Bitcoin among pension funds. For instance, by the end of September, the Wisconsin State Investment Board became the 12th largest stakeholder in BlackRock’s Bitcoin ETF, with a stake valued at an impressive $155 million.

Michigan has also made significant progress by becoming the sixth-largest investor in Grayscale’s Ethereum ETF, valued at over $12 million. These investments have gained value due to a 50% surge in Bitcoin prices in recent months.

The interest in Bitcoin is not limited to the US; pension fund managers in the UK and Australia have also made allocations. AMP, a leading pension fund manager in Australia, recently started investing in Bitcoin futures to enhance returns on its portfolios.

The Benefits and Risks of Bitcoin for Pension Funds

Naturally, the appeal of investing in Bitcoin lies in its potential for substantial returns. Nonetheless, pension funds are fully aware of the volatility and regulatory uncertainty that comes with cryptocurrencies. Past failures, such as the collapse of the FTX exchange in 2022, which resulted in a $95 million loss for the Ontario Teachers’ Pension Plan, highlighted these dangers.

However, the ongoing cryptocurrency boom, spurred by the prospect of a supportive pro-crypto administration in the US, has rekindled interest in the market. With predictions of Bitcoin’s value potentially doubling, some analysts foresee a continued rise in pension funds’ investments in cryptocurrency.

Cautious Exploration of Bitcoin: Careful Yet Interested

Even as more individuals begin to show interest in Bitcoin, pension funds remain extremely prudent when it comes to the cryptocurrency market.

Several funds choose to invest in Bitcoin via ETFs or derivatives that provide access to the asset class without direct exposure.

While Bitcoin is still a speculative and volatile asset, the interest from pension funds is a sign that retirement portfolios are being managed differently. The growing adoption of cryptocurrencies by conservative investment bodies reflects their potential as high-return assets, despite the risks.

So pension funds seeking to balance growth with stability are most likely to look further for Bitcoin and other cryptocurrencies as part of their portfolios. Technology may mature and regulatory frameworks most probably change and develop, but crypto may indeed become a part of the pension strategy in the following years.