Eric Trump stated that the upcoming administration led by his father will establish clear and reasonable regulations for the cryptocurrency sector.

According to Eric Trump, an American businessman and the second son of Donald Trump, traditional global banking systems are outdated, and it is only a matter of time before cryptocurrency and blockchain technology outpace them.

In an interview on Dec. 9 with CNBC’s Dan Murphy in Abu Dhabi, before his keynote at the Bitcoin Conference, the third-oldest child of US President-elect Donald Trump mentioned that blockchain technology can perform all the tasks of contemporary banking systems, but in a superior way.

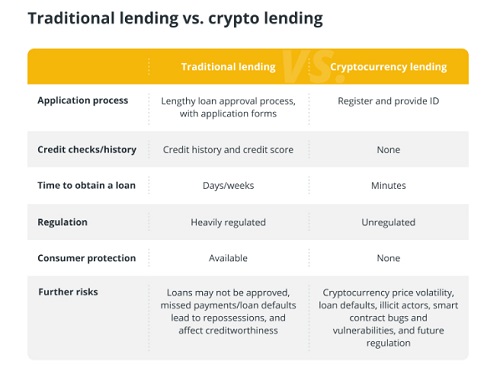

“If you reside in America and want to secure a home loan, it takes you 90 days; how is it possible that obtaining a home loan takes 90 days? By that time, the house is already sold, and your dream is gone,” he remarked.

“There is nothing on blockchain that cannot be executed more efficiently, faster, significantly cheaper, and without the need for paperwork.”

Eric Trump noted that his father “understands that every nation globally” is adopting cryptocurrency in one way or another, and if the United States doesn’t take the lead in aspects like regulation, there’s a risk of being “left behind.”

Numerous pro-crypto candidates secured positions in Congress, and some industry leaders have indicated that the new Congress could be the most supportive of cryptocurrency in history, which should lead to a more favorable regulatory landscape.

Eric Trump expressed optimism that soon there will be clear and rational regulations for the sector, which will be advantageous for the U.S.

“We will establish a transparent framework, and hopefully the rest of the world will follow suit.”

“Hopefully, we can set an example because that’s what we, as Americans, should do. And ideally, we can establish ourselves as the global leader in cryptocurrency,” he added.

Trump and his brother Donald Jr. play significant roles in the decentralized finance (DeFi) platform World Liberty Financial, although they are not directly employed according to the website.

Additionally, he mentioned that X CEO Elon Musk is poised to have a substantial role in the new White House, beyond co-leading the Department of Government Efficiency (DOGE) with Vivek Ramaswamy.

“I believe we want to witness real innovation again. I think we want the government to step aside and allow great businesses to thrive,” Trump remarked.

“Unfortunately, that hasn’t been the case in America for the past four years, but it’s about to change. I believe Elon will play a crucial role in ensuring that everything comes together,” Trump added.

Blockchain technology, recognized for its decentralized and transparent characteristics, is advancing the financial services sector.

The capacity of blockchain to tokenize assets, meaning creating digital representations of both physical and financial assets, promises improved transparency, increased liquidity, and operational efficiencies.

The shift towards a blockchain-focused financial sector is hastening, with the tokenized market valuation anticipated to reach approximately $2 billion by 2030. Renowned users, including JPMorgan and BlackRock, utilize blockchain for various applications such as digital identity verification and trade finance, indicating a strong future for blockchain in banking.

Earlier this year, BlackRock’s CEO, Larry Fink, stated: “We foresee that the next phase will involve the tokenization of financial assets, which means every stock and every bond […] will exist on a single general ledger.”

A recent report by McKinsey & Company titled ‘Tokenised financial assets: Moving from pilot to scale’ indicates that tokenization has reached a crucial point, laying the groundwork for large-scale implementations that promise enhanced liquidity, operational efficiencies, and new revenue opportunities.

What blockchain platform or technology do banks utilize, and why?

Dr. Scott Zoldi, Chief Analytics Officer at FICO, comments: “Some of the most exciting new applications of blockchain involve using permissioned and private blockchains, like Hyperledger Fabric, which allows for controlled access, transaction visibility, and simpler consensus models.

“These private blockchains offer a balance of control, access, and scalability issues compared to traditional public blockchains. Banks prioritize the appropriate level of access, consensus, and protections while weighing the costs and benefits of employing blockchain technology,” Zoldi elaborates.

Nick Jones, Founder and CEO of Zumo, notes the diverse adoption of blockchain platforms among banks. “Various banks are utilizing different platforms for an expanding array of use cases as their interest in the technology increases,” he observes.

HSBC has also launched a blockchain-based trade finance solution to digitize and streamline its operations, specifically employing the R3 blockchain platform. The R3 Corda platform, tailored for the financial services sector, enables the secure sharing of trade documents, such as letters of credit and invoices.

“Other banks are now concentrating on how they can utilize blockchain technology to help their clients safely explore the opportunities that cryptocurrency presents,” Jones adds.

How can blockchain technology’s integration affect the processing times and expenses of banks? Nick is a strong advocate for the transformative abilities of blockchain technology in the banking sector.

“Blockchain enables real-time processing and maintains unchangeable transaction records, allowing banks to speed up transaction processing while also minimizing the workforce—resulting in lower costs,” he claims.

A recent study by Juniper Research suggests that financial institutions involved in cross-border payments could save $10 billion by 2030 due to blockchain settlements. Similarly, a study from Uniswap indicates that on-chain cross-border and FX payment fees could be slashed by as much as 80%.

Kurt Wuckert Jr, Chief Bitcoin Historian at CoinGeek, emphasizes the efficiency improvements that blockchain technology offers: “Blockchain can greatly enhance transaction processing speeds and lower expenses by removing intermediaries and increasing transparency. Traditional banking transactions often necessitate several intermediaries, leading to delays and higher costs.

“Blockchain’s distributed ledger facilitates real-time transaction settlements, decreasing processing times from several days to mere seconds. Furthermore, reduced intermediary involvement results in decreased transaction fees. However, the current financial infrastructure is still deeply rooted.”

The adoption of blockchain technology will enable banks to significantly reduce processing durations and costs. Traditional methods of transferring money can take anywhere from three to five days.

Dr. Scott Zoldi states: “Transaction fees are usually exorbitant compared to blockchain methods.

“Additionally, the penalty for executing a transaction incorrectly on traditional methods is extremely high—traceability poses major challenges. Once a misplaced transaction is tracked down, banks incur numerous FX charges and correspondent banking fees to reclaim it.

“In contrast, using a digital asset allows banks to move value instantly at significantly lower costs, largely because there’s no convoluted correspondent banking system to navigate.”

The benefits of blockchain, ranging from cost reductions to enhanced operational efficiency, are becoming increasingly apparent to financial institutions.

What strategies can be utilized to guarantee data security and privacy on a blockchain network? Safeguarding the security and privacy of information on blockchain networks continues to be a critical concern for financial institutions. All information recorded on a blockchain is encrypted, ensuring it remains secure from unauthorized access.

“Only individuals with the proper permissions—or keys—can access the information. While the data is encrypted, the transactions themselves remain transparent and unalterable,” Nick explains.

Dr. Scott Zoldi mentions that private blockchains with strict access control protocols are frequently employed to protect data assets. “Public blockchains are generally not suitable due to the sensitive nature of various transactions that banks need to preserve. There must be careful consideration of what information is retained.

“Ongoing evaluations of smart contracts are crucial for upholding network integrity. These audits help to identify and correct vulnerabilities, and there’s a growing trend towards implementing ISO certification in apps and contracts, although its use is still limited. Multi-signature authentication, which necessitates multiple keys for transaction approval, helps prevent single points of failure, providing an additional layer of security against unauthorized transactions.”

The BSV Association is looking into innovative approaches like Network Access Rules (NAR). This strategy involves a non-profit association sharing a legal agreement with nodes on the network, creating a clear guideline for addressing issues such as theft or unintentional asset destruction, like when a user inadvertently “burns” their private keys.

Barry stresses the significance of these practices in banking. “Ensuring security and privacy on a blockchain network is critical, particularly in banking. Encryption and cryptographic techniques are vital to safeguard data from unauthorized access and tampering.

“Banks can adopt multi-signature transactions, requiring multiple parties to endorse a transaction before it’s completed, adding another layer of security. Moreover, zero-knowledge proofs enable banks to validate transactions and identities without disclosing sensitive information.

“Ultimately, implementing zero-knowledge proofs can greatly bolster privacy. This method allows for verification of transactions without revealing confidential data, ensuring transaction integrity is upheld without compromising user privacy.”

How does blockchain technology align with current IT infrastructure and legacy systems? “Zumo’s creative strategy for integrating digital assets into conventional banking frameworks uses APIs to streamline the process.” As Nick Jones explains, its Crypto Invest solution provides a digital asset custody and trading service that can be smoothly integrated into a bank’s current IT framework.

“This offers consumer-oriented retail banks a compliance-driven pathway to present customers with the choice to invest in digital assets,” says Nick. By doing so, banks can create additional revenue streams, allowing customers to buy, hold, and sell cryptocurrencies within the familiar environment of their banking platform.

Acknowledging the regulatory and operational hurdles that banks encounter, Nick Jones advocates for a sustainable and long-term strategy, emphasizing the need to build the requisite infrastructure. For banks to successfully incorporate digital asset offerings into their business models, they need to tackle the financial, operational, and environmental sustainability of the initiative.

Similarly, Kurt Wuckert points out the practicality of a hybrid model for banks, where blockchain solutions are gradually introduced in conjunction with existing systems. APIs can enable communication between blockchain technologies and legacy systems, facilitating data exchange and process automation without requiring a complete system overhaul.

Kurt Wuckert mentions that middleware solutions can act as intermediaries, connecting new blockchain applications with traditional IT frameworks. However, smooth integration requires extensive testing, employee training, and a willingness to embrace new workflows. This gradual method allows banks to modernize their operations while ensuring stability and compliance.

Can you provide examples of pilot projects or use cases within a bank that demonstrate the effective implementation of blockchain technology? Nick Jones emphasizes the considerable role of blockchain technology in the sustainability arena: “Our recent study with the Crypto Carbon Ratings Institute (CCRI) indicated that, as of March 2024, the annualized carbon output of all physically backed Bitcoin fund products was 4487.93 kilotonnes of carbon dioxide (ktCO2).

“The annualized carbon output of the US Exchange-Traded Fund (ETF) cohort that launched in January 2024, after receiving approval from the US Securities and Exchange Commission (SEC), was 2056.86 ktCO2. This new cohort secured nearly half (45.8%) of the market share for physically backed Bitcoin funds within just a few months.”

With the acceptance of crypto fund products by the London Stock Exchange (LSE) and the Hong Kong Securities and Futures Commission (SFC), Jones foresees rapid expansion in this sector.

Jones underscores the necessity of addressing environmental responsibilities: “Banks need to tackle this issue in accordance with increasing investor expectations and new regulations, such as the EU’s Corporate Sustainability Reporting Directive (CSRD), which mandates companies to report Scope 3 emissions. This cannot simply be overlooked.”

Dr. Scott Zoldi identifies another vital application of blockchain technology in fostering AI model development and operational use. “By establishing responsible AI standards and frameworks, blockchain can formalize the essential requirements needed to comply with regulatory standards and release the AI model/system.

“This guarantees that no AI is deployed unless all necessary requirements and regulatory standards are satisfactorily fulfilled, offering an immutable record of AI development and decision-making for future production use.”

Kurt highlights significant pilot projects that illustrate blockchain’s possibilities in financial services.

“JPMorgan’s Interbank Information Network (IIN), developed on Quorum, an enterprise-focused variant of Ethereum, seeks to solve interbank information sharing issues by offering a secure, efficient platform for cross-border payments, he says. “More than 300 banks have become members of the network, underscoring its potential to transform interbank transactions by minimizing delays and operational expenses.

“Santander’s utilization of Ripple’s blockchain technology for international payments serves as another example. Santander’s One Pay FX platform harnesses Ripple’s blockchain to facilitate same-day international transfers with greater transparency and lower fees relative to traditional methods.”

These case studies highlight the significant potential of blockchain technology in reshaping financial services, improving efficiency, and decreasing costs, despite the overall speculative and volatile nature of the blockchain economy.