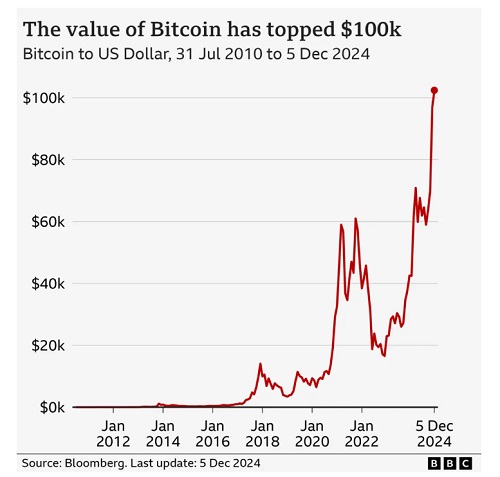

The cost of Bitcoin has, for the first time, surpassed the $100,000 threshold, reaching a new all-time high.

The price surge of the world’s leading cryptocurrency has been fueled by optimism that US President-elect Donald Trump will implement policies favorable to cryptocurrencies.

This milestone was achieved mere hours after Trump announced that he would appoint former Securities and Exchange Commission (SEC) commissioner Paul Atkins to oversee the Wall Street regulator.

Mr. Atkins is perceived to be significantly more supportive of cryptocurrencies compared to the current SEC chair, Gary Gensler.

The achievement of the $100,000 milestone sparked celebrations among cryptocurrency enthusiasts globally.

The erratic price movements of Bitcoin have consistently drawn attention, with supporters expressing joy during price surges and resilience during downturns.

However, this particular milestone has been particularly eagerly awaited. For weeks, various charts, memes, and forecasts circulated on social media regarding the timing of Bitcoin reaching the figure considered one of the holy grails in the crypto community.

Millions of viewers tuned into online watch parties as the price approached the $100k mark.

The price of a single bitcoin serves as one of the indicators of optimism in the cryptocurrency sector, which is currently valued at approximately $3.3 trillion, according to the analysis firm Coin Market Cap.

Trump’s recent electoral win was the trigger for the latest price increase.

The president-elect has pledged to turn the US into “the crypto capital of the planet” – a remarkable shift considering that as recently as 2021 he labeled Bitcoin a “scam.”

Equally astonishing is the rapid rise in Bitcoin’s value. A valuation of $100k marks a 40% increase since election day in the U.S. and more than double the price at the year’s start.

However, there is much more to Bitcoin beyond its stunning price fluctuations.

From the enigmatic figure behind its creation to the downfall of the so-called Crypto King, it’s a narrative filled with numerous twists and turns, resulting in the creation – and loss – of significant fortunes.

So here is the BBC’s compilation of the seven most astonishing moments – thus far – in Bitcoin’s turbulent journey.

1. The enigmatic creator of Bitcoin

Despite its immense profile, the true identity of Bitcoin’s creator remains a mystery. The concept was initially shared on internet forums in 2008 by someone using the name Satoshi Nakamoto.

They outlined a peer-to-peer digital cash system designed to enable individuals to transfer virtual currency over the internet as easily as sending an email.

Satoshi developed a sophisticated computer protocol that would process transactions and generate new coins, utilizing a vast network of self-selected volunteers worldwide who operated specialized software and powerful computers.

However, this person – or group – has never disclosed their identity, and the truth remains elusive.

In 2014, Japanese-American Dorian Nakamoto was hounded by journalists who believed he was the secretive Bitcoin creator, but this turned out to be a false lead stemming from some mistranslated information.

Australian computer scientist Craig Wright claimed to be the creator in 2016 – but after years of legal disputes, a High Court judge determined that he was not Satoshi.

Earlier this year, Canadian Bitcoin specialist Peter Todd vehemently denied being Satoshi, while a British individual, Stephen Mollah, asserted he was – yet no one took him seriously.

2. Making history… with pizza

Bitcoin now forms the foundation of a multi-trillion-dollar cryptocurrency industry – but its first documented transaction was for the purchase of pizza.

On May 22, 2010, Lazlo Hanyecz proposed $41 worth of Bitcoin on a crypto forum in exchange for two pizzas.

A 19-year-old student accepted his offer, and that day became a significant moment in history for supporters of the currency, celebrated as #BitcoinPizza day.

This event has inspired numerous memes within the crypto community and illustrated Bitcoin’s potential as a form of online currency capable of purchasing real goods.

Criminals likely took notice as well, since within a year, the first darknet marketplace emerged, enabling the trade of drugs and other illegal products for Bitcoin.

Looking back, the deal wasn’t favorable for Lazlo. Had he held onto those bitcoins, they would now be worth hundreds of millions of dollars!

3. Becoming legal tender

In September 2021, El Salvador’s President Nayib Bukele made Bitcoin legal tender.

Businesses such as hair salons, supermarkets, and others were mandated to accept Bitcoin as a valid form of payment alongside the primary currency, the US dollar.

This move attracted many Bitcoin advocates and journalists to the area, providing a brief boost to tourism in the country.

While President Bukele hoped this decision would encourage investment in his nation and reduce the costs for citizens exchanging money, it did not gain the popularity he anticipated.

He remains optimistic about its potential, but for the time being, the US dollar continues to reign supreme in the country.

In addition to the significant public funds President Bukele invested in encouraging Bitcoin adoption, he also made headlines by purchasing over 6,000 bitcoins in recent years.

The president allocated no less than $120 million to acquire bitcoins at different prices, hoping to generate profits for his financially struggling nation.

Things began to look promising for him in December 2023, as his Bitcoin holdings experienced a substantial increase in value for the first time.

A website created by Dutch software engineer Elias Zerrouq is monitoring the country’s Bitcoin assets and currently estimates that their value has surged by 98%.

4. The rise and fall of Kazakhstan’s cryptocurrency sector

In 2021, Kazakhstan emerged as a prime location for Bitcoin mining – the activity of performing complex calculations essential for cryptocurrency transactions.

Today, this process requires vast warehouses filled with advanced computers running continuously, but the incentive is the opportunity to earn new bitcoins for participating companies.

Due to its abundant electricity supply, sourced from considerable coal reserves, many businesses relocated to Kazakhstan.

Initially, the government embraced these companies warmly, as they brought in investment.

However, an influx of miners soon created a heavy burden on the electrical grid, putting the nation at risk for blackouts.

Within a year, Kazakhstan’s Bitcoin mining sector transitioned from prosperity to decline when the government imposed limits and increased taxes to manage the expansion.

Globally, it is estimated that the Bitcoin network consumes as much electricity as a small nation, raising concerns regarding its environmental effects.

5. Bitcoins lost in the landfill

Imagine having a cryptocurrency wallet valued at over $100 million (£78 million) and inadvertently discarding a hard drive containing your access credentials.

This scenario describes what James Howells from South Wales claims occurred to him.

The inherently decentralized nature of crypto means retrieval is not as straightforward as resetting a password. With no banks involved, there is no customer support service available.

Sadly for him, the local council in Newport denied him access to the landfill site where he believes the device ended up, even after he proposed donating 25% of his Bitcoin fortune to local charities if granted access.

He expressed to the BBC: “It was a penny dropping moment and it was a sinking feeling.”

6. The fraud of the Crypto King

No one has lost more Bitcoin than former billionaire crypto entrepreneur, Sam Bankman-Fried. The founder of the influential crypto platform FTX was known as the Crypto King and had a strong following in the community.

FTX was a cryptocurrency exchange that permitted users to trade traditional money for cryptocurrencies like Bitcoin.

His empire was valued at approximately $32 billion, and he was enjoying tremendous success until everything collapsed within a matter of days.

Investigative reporters revealed that Bankman-Fried’s company was financially unstable and had been illegally diverting FTX customer funds to support his other enterprise, Alameda Research.

Just before his arrest in December 2022 at his luxurious apartment in the Bahamas, he spoke with reporters and stated: “I don’t think I committed fraud. I didn’t want any of this to happen. I was certainly not nearly as competent as I thought I was.”

After being extradited to the US, he was convicted of fraud and money laundering and sentenced to 25 years in prison.

7. The surge in investment banking

Amid the chaos, Bitcoin continues to capture the interest of investors and major corporations.

In fact, in January 2024, some of the largest financial institutions in the world began including Bitcoin in their official asset portfolios as Spot Bitcoin ETFs. These work like stocks and shares, connected to the value of Bitcoin without requiring personal ownership.

Investors have been pouring billions into these new offerings. Firms such as Blackrock, Fidelity, and GrayScale have also been accumulating bitcoins in the thousands, driving its value to unprecedented levels.

This marks a significant milestone for cryptocurrency, with some enthusiasts believing that Bitcoin is at last receiving the respect envisioned by its elusive creator, Satoshi.

Nevertheless, many anticipate more unpredictable developments as the Bitcoin narrative progresses.

Bitcoin’s value has surpassed the highly awaited $100,000 mark, prompting inquiries about how high it might ultimately rise and whether it can overcome its well-known volatility.

The world’s dominant cryptocurrency reached approximately $103,400 shortly after 04:00 GMT on Thursday, only to slightly retract afterward.

Dan Coatsworth, an investment analyst at AJ Bell, referred to it as a “magic moment” for cryptocurrencies and noted a “clear link” to Donald Trump’s election win.

Trump took to social media to celebrate this achievement, writing “congratulations Bitcoiners” and “you’re welcome!”

The president-elect had previously vowed to establish the US as the “crypto capital” and a “Bitcoin superpower” globally, contributing to the increase in Bitcoin’s price post-election.

The price broke through the $100k threshold after Trump announced he would nominate former Securities and Exchange Commission (SEC) commissioner Paul Atkins to oversee the Wall Street regulator.

Mr. Atkins is regarded as significantly more supportive of cryptocurrency compared to the current leader, Gary Gensler.

“There’s clearly an expectation that the new administration will be somewhat more favorable towards crypto than the previous one,” stated Andrew O’Neill, an expert in digital assets at S&P Global.

“For Bitcoin’s price, I believe this is what has driven the current trend, and it will likely persist into the new year,” he continued.

Nonetheless, Bitcoin has a track record of abrupt declines as well as swift increases – and some analysts have warned that this pattern is unlikely to change.

“Many individuals have gained wealth from the surge in cryptocurrency values this year, but this high-risk asset isn’t appropriate for everyone,” remarked Mr. Coatsworth.

“It’s unstable, erratic, and influenced by speculation, none of which makes for a relaxing investment.”

The Trump influence

Throughout the US presidential election campaign, Trump attempted to appeal to cryptocurrency investors by pledging to remove Gary Gensler – chair of the US financial regulatory body the Securities and Exchange Commission (SEC) – on the “first day” of his presidency.

Mr. Gensler’s stance towards the cryptocurrency industry has been noticeably less accommodating than Trump’s.

He mentioned to the BBC in September that the industry is “laden with fraud and con artists.”

During his term, the SEC initiated a record-setting 46 enforcement actions related to crypto against companies in 2023.

Mr. Gensler announced in November that he would resign on January 20 – the same day as Trump’s inauguration.

The selection of Paul Atkins to succeed him as head of the SEC has been positively received by supporters of crypto.

Mike Novogratz, the founder and CEO of US crypto company Galaxy Digital, expressed hope that the “more explicit regulatory framework” would now hasten the digital currency ecosystem’s integration into “the financial mainstream.”

Bitcoin has exhibited fewer significant drops in price in 2024 compared to prior years.

In 2022, its value plummeted sharply below $16,000 following the bankruptcy of the crypto exchange FTX.

Aside from Trump’s electoral win, several key developments have contributed to increased investor optimism regarding its continued appreciation.

The SEC approved multiple spot Bitcoin exchange-traded funds (ETFs), enabling large investment firms such as Blackrock, Fidelity, and Grayscale to offer products linked to Bitcoin’s price.

Some of these offerings have experienced billions of dollars in cash inflows.

However, the risk of a sudden value crash serves as a reminder that Bitcoin is not comparable to traditional currencies – and investors lack protection or recourse if they incur losses in Bitcoin investments.

Carol Alexander, a finance professor at Sussex University, told BBC News that fear of missing out (FOMO) among the younger demographic will likely drive Bitcoin’s price to keep rising.

Yet, she cautioned that while this might incite an increase in other cryptocurrencies, many younger investors in meme coins are losing money.

Kathleen Breitman, co-founder of the cryptocurrency Tezos, also issued a warning to those considering investing in Bitcoin.

“These markets generally operate on momentum, so it’s essential to proceed with extreme caution,” she advised BBC.