Cryptocurrency exchange Binance has not yet determined the location of its global headquarters, its CEO informed Reuters on Monday, several years after indicating that a decision was close. The executive highlighted efforts the company has made to enhance corporate governance.

“We are diligently working on this (the HQ). It’s a multifaceted issue with various complexities,” CEO Richard Teng stated in an interview during the Abu Dhabi Finance Week annual conference.

Binance, which is the largest cryptocurrency exchange in the world, has previously stated that an announcement regarding its global HQ would arrive shortly. Revealing the head office’s location is seen as part of its initiative to increase transparency following legal issues involving its former CEO Changpeng Zhao.

Zhao, often referred to as “CZ,” admitted guilt to violating U.S. anti-money laundering laws while at Binance and spent several months in jail earlier this year.

Teng mentioned that the decision regarding the HQ’s location would depend on tax regulations and the capability to attract talent. He stated that Binance is “still in deep discussions” with multiple jurisdictions but did not specify which ones.

So far, the company has secured 20 licenses and registrations globally, as noted on its website, including approvals in Abu Dhabi and by Dubai’s virtual assets regulator VARA earlier this year.

Earlier this year, Binance formed a board of directors for the first time, which consists of seven members, including three independent directors. “Binance has transitioned from a founder and CEO-led organization to a board-led one,” Teng explained to Reuters, adding that he occasionally communicates with Zhao, stating the former CEO “has all the rights associated with any shareholder of any company.”

Last week, the largest cryptocurrency, bitcoin, reached a historic high exceeding $100,000 amid anticipations that the incoming U.S. President-elect Donald Trump’s administration will implement a more relaxed regulatory framework for cryptocurrencies.

While attending the annual gathering of global and regional financiers, Teng noted that Binance is a sponsor of a bitcoin conference featuring Eric Trump, the son of the U.S. president-elect, as a speaker.

“On a global scale, expect to see much more progressive regulations being adopted,” Teng mentioned when asked about the potential influence of the new U.S. administration on the thriving sector.

Should the U.S. establish a strategic bitcoin reserve, as suggested by Trump, Teng predicts that “many other countries will follow suit.”

Richard Teng, Binance’s CEO, still refrains from revealing where the world’s dominant crypto exchange will set up its global headquarters.

However, the former Abu Dhabi regulator stated that the United Arab Emirates appears “very attractive” as a potential site.

“We have invested a considerable amount of time into selecting a global HQ,” Teng told DL News during the Abu Dhabi Finance Week. “We will inform you once we arrive at a final decision.”

When inquired if Abu Dhabi or Dubai, the two largest cities in the UAE, were primary candidates, he chose not to comment.

Central office

Binance has historically steered clear of disclosing the location of its headquarters.

During his time in the role, Changpeng Zhao, co-founder and former CEO of Binance, asserted that, unlike traditional businesses, the exchange did not require a centralized office.

“Wherever I am will serve as the Binance office,” he declared in 2020 at a crypto conference.

The location of a company is an essential aspect of corporate governance as it indicates the laws and authorities that govern its operations.

This is particularly significant for firms in the financial markets where clients and traders must have confidence that companies will protect their investments.

After Zhao pleaded guilty to contravening U.S. banking laws in November 2023, Teng assumed leadership and aimed to reassure both regulators and clientele that Binance was rectifying its previous missteps.

That month, Binance accepted guilt for enabling criminal activities on its platform and agreed to pay $4.3 billion in fines to the U.S. Department of Justice and other agencies.

As part of the plea agreement, the company appointed independent monitors to supervise its anti-money laundering and sanctions compliance practices.

Teng has initiated additional measures to reform the crypto exchange.

In April, Binance established its first board of directors, with Gabriel Abed, the former Barbados ambassador to the UAE, acting as chairman.

Crisis in Nigeria

In his discussion with DL News, Teng also opted not to share any further updates regarding Binance’s ongoing legal issues in Nigeria.

For roughly eight months, the Nigerian government detained Tigran Gambaryan, the leader of Binance’s financial crimes compliance unit and a U.S. citizen.

In May, Nigerian authorities brought Gambaryan and Binance to trial on money-laundering accusations.

As the trial progressed, Gambaryan’s health deteriorated.

After pressure from the Biden administration, the Nigerian government released Gambaryan in October, allowing him to return to the U.S.

However, Binance remains embroiled in legal proceedings in Africa’s most populous nation.

“We will robustly defend our position,” Teng told DL News. “We are not at liberty to discuss further.”

Talking to CZ

The CEO of Binance avoided answering questions regarding the exchange’s future plans in the US.

He also chose not to clarify Zhao’s involvement in the company he launched seven years ago. Teng mentioned that he communicates with the former CEO “very infrequently.”

When asked if Yi He, a co-founder of Binance who retains a significant role, discusses the company with Zhao, Teng suggested that’s a question for her.

After announcing a partnership with stablecoin leader Circle, Teng refrained from revealing whether Binance intends to create its own stablecoin.

“At this stage, it’s too early,” he remarked. “We are concentrating on our partnerships.”

Corporate Governance

The delay in finalizing a headquarters coincides with Binance’s major corporate restructuring as it seeks to rebuild trust after a challenging year.

Earlier in 2023, former CEO Changpeng Zhao, known as “CZ,” admitted guilt to breaching U.S. anti-money laundering laws, a legal issue that resulted in him spending several months incarcerated.

This year, Binance reportedly formed its first-ever board of directors to enhance transparency. The seven-member board includes three independent directors, marking a significant shift from its previous founder-led structure.

The company is now managed by a board of directors, indicating a transformation from a founder-centric organization.

In its pursuit of global recognition, Binance has reportedly obtained 20 licenses and registrations globally, including in Abu Dhabi and Dubai.

The UAE has emerged as a potential center, with Teng attending prominent events and Binance sponsoring a concurrent Bitcoin conference featuring distinguished speakers.

Moreover, Binance’s leading executive pointed to tax regulations and the ability to attract top talent as crucial factors in making this decision.

These elements, along with ongoing negotiations in various areas, are influencing the direction of the final decision.

Top Performance in November

Bitcoin recently achieved an all-time high exceeding $100,000, spurred by speculation that the US might adopt a more favorable regulatory approach under President-elect Donald Trump.

If the US adopts a strategic Bitcoin reserve, Teng anticipates a cascading effect, prompting other countries to follow suit.

The cryptocurrency market surge in November was reflected in market activity metrics, including the trading volumes of major cryptocurrency exchanges.

According to Finance Magnates Intelligence’s analysis, market turnover rose by an average of 180% compared to the previous month and year.

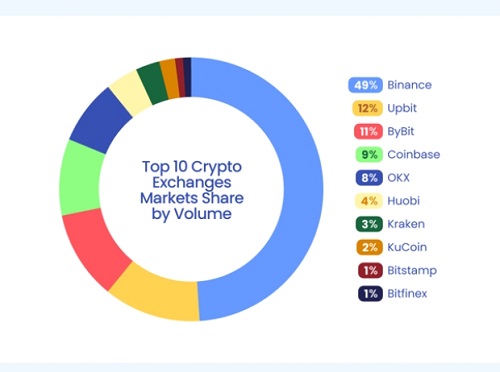

Binance led the top 10 cryptocurrency exchanges with a 49% market share, followed by Upbit at 12%.

Bybit, Coinbase, and OKX rounded out the top five with shares of 12%, 11%, and 9%, respectively.

The list also included Huobi, Kraken, KuCoin, Bitstamp, and Bitfinex.

Crypto giants Binance and Circle team up to take on Tether

Two of the leading names in cryptocurrency are putting aside their historical rivalry to collaborate and capture a larger share of the rapidly expanding stablecoin market.

On Wednesday morning in Abu Dhabi, Binance and Circle revealed a strategic partnership aimed at promoting USDC, a digital token that is backed 1:1 by the U.S. dollar and co-owned by Circle and Coinbase.

This announcement coincides with the growing integration of stablecoins into mainstream finance, with more competitors emerging to challenge the market leader Tether.

Binance, the world’s largest cryptocurrency exchange, once played a significant role in the stablecoin market with its native BUSD coin reaching a market capitalization of approximately $23 billion.

However, the company faced significant regulatory pressure concerning alleged compliance issues, which forced it to discontinue BUSD in late 2023.

During this time, Circle frequently criticized both Binance and Tether as operating recklessly.

The decision by Circle and Binance to forge a partnership follows Binance’s settlement with the U.S. Justice Department, which subjects it to oversight by multiple U.S. agencies.

“Binance has undergone a thorough transformation of its operations, and over time, we mutually agreed that it made sense to collaborate with one of the world’s most trusted and regulated stablecoins,” stated Circle’s chief business officer, Kash Razzaghi, to Fortune.

The outcome is that Circle seems to have reconciled with its former rival in order to leverage Binance’s extensive network and discover new customers for USDC.

Binance will now benefit from its new partner’s strong relationships with the U.S. government and other regulatory bodies, helping it re-enter the stablecoin market.

However, the notable change is that Binance will need to collaborate with two additional players since Coinbase holds a significant minority interest in the revenues generated by USDC. The companies have kept details about the revenue-sharing terms in this new three-party agreement under wraps, but individuals familiar with the transaction have informed Fortune that Binance will not gain an equity interest in Circle.

In a press release announcing this collaboration, the companies indicated that Binance will start incorporating USDC into its corporate treasury operations, potentially increasing the overall supply of the token due to the exchange’s massive scale. Coinbase, on the other hand, has presented this partnership as a means to boost USDC’s adoption.

“We’re thrilled to have more partners like Binance enhance the growth of the USDC ecosystem. As we add more partners to the USDC ecosystem, the circulation of USDC will continue to rise, fostering greater economic freedom globally and propelling the industry forward on a foundation of transparency and trust,” stated Shan Aggarwal, Vice President and head of business development at Coinbase.

Can anyone rival Tether?

To understand the stakes involved, USDC is currently the second-largest stablecoin, boasting a market capitalization close to $40 billion, while the less regulated Tether dominates with a market cap of $138 billion. Other issuers hold relatively small market shares, such as PayPal, whose PYUSD stablecoin has a market capitalization of approximately $500 million.

Crypto traders have long favored stablecoins because, unlike Bitcoin and other cryptocurrencies, they are stable and provide a means to hold digital assets without incurring the costs associated with converting crypto to fiat currency.

Meanwhile, stablecoin issuers such as Circle and Tether have profited significantly from the interest accrued on the reserves that back these coins. In the future, stablecoins—which can be transferred at any hour for a minimal cost—are projected to gain popularity in areas like remittances, trade finance, and corporate treasury management.

The partnership formed by Circle and Binance comes at a crucial time for the adoption of stablecoins, particularly as the incoming Trump administration is overtly supportive of cryptocurrency and aims to collaborate with Republicans in Congress to pass legislation that facilitates the use of tokens in commerce.

This scenario raises the question of whether the combination of these factors will pose a serious threat to Tether, which has been the primary stablecoin for a significant segment of the crypto market for over a decade. Despite enduring criticism regarding its approach to the popularity of its stablecoin among criminals and concerns about its accounting practices, Tether has maintained its leading position and amassed significant profits in the process.

Tether has reported quarterly profits exceeding $1 billion in periodic attestation statements and claims to possess a substantial war chest comprising billions in free capital. Over the past two years, the company has been so financially stable that it has made considerable investments into AI startups.

However, Tether might be at risk due to the distrust it has cultivated with the U.S. and other governments. Although Tether has recently started to engage lobbyists to advocate for it in Washington, D.C., Circle and its USDC partners are likely in a more favorable position to gain trust from cautious financial firms entering the cryptocurrency market (despite Tether having a vital supporter in financial giant Cantor Fitzgerald, which manages the company’s cash reserves and whose CEO, Howard Lutnick, has been nominated by Trump to serve as commerce secretary).

In addition to Tether, the newly formed Binance-Circle alliance will soon face competition from another group. In November, Paxos, a New York-based stablecoin issuer that previously assisted Binance with its now-defunct BUSD coin, announced the “Global Dollar Network” along with six other companies, including the established crypto platform Kraken and the financial technology leader Robinhood.

While contenders to Tether and USDC have yet to gain significant traction, the new Global Dollar Network is pursuing an innovative model designed to return nearly all profits generated from reserves to its members, who will, in turn, pass these returns to customers as yields. Paxos asserts that this offering is fully compliant, and its collaborators believe that this upcoming stablecoin will disrupt the market and encourage institutions to shift away from Tether and USDC, which offer minimal or no returns. At present, however, the Global Dollar Network is still an unproven solution.

The upcoming year will be significant in determining whether USDC or another stablecoin can challenge Tether’s supremacy, and it is also possible that the developing legal frameworks worldwide to support cryptocurrency may enable all competitors to thrive simultaneously. For now, the main takeaway is how rapidly the cryptocurrency landscape is evolving.