Ripple is a payment company focused on international money transfers. The company utilizes blockchain technology to achieve this. RippleNet is a payment transfer network created by Ripple Labs Inc., which is accessible to financial institutions globally. The company also utilizes the XRP token.

XRP serves as the native token for the decentralized blockchain known as XRPLedger. Ripple Labs utilizes this token to enable transactions on the XRPLedger, allowing financial institutions to transfer value across borders seamlessly. Thus, XRP facilitates instantaneous and trustless payments on the XRPLedger chain, helping financial institutions reduce transaction costs worldwide.

XRP employs the interledger standard, which is a blockchain protocol that facilitates payments between various networks. For example, XRP’s blockchain can link the ledgers of multiple banks, thereby eliminating intermediaries and the need for a centralized system. XRP is the native token of the XRPLedger blockchain, developed by Jed McCaleb, Arthur Britto, and David Schwartz.

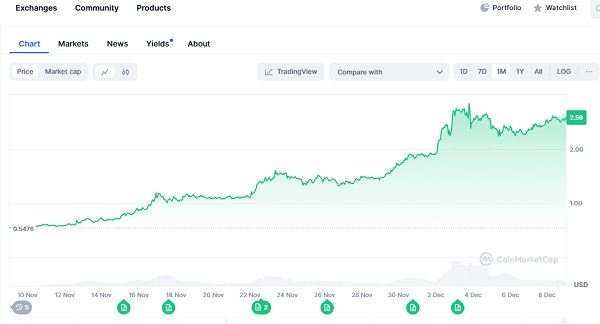

Ripple’s XRP saw a 7% increase on Friday as large holders continued to retain their tokens, despite significant profit-taking from retail traders. This behavior from large holders may drive XRP towards a new all-time high at $3.57.

On-chain data for XRP displays a bullish attitude, even amid significant profit-taking. After its rally that pushed XRP to a four-year high of $2.91 on Tuesday, it experienced a pullback, dropping around 17% over the next three days.

This decline may have been triggered by heightened profit-taking, according to the XRP Network Realized Profit and Loss indicator, which suggests that investors have realized gains exceeding $5.86 billion since December 1. Such profit-taking is common during bull markets, particularly when prices hit new peaks.

The increasing selling activity is reflected in the XRP Mean Coin Age metric, which indicates that selling was rising across all coin age groups, particularly within the 2-3 year category. A decline in this metric signals distribution within that specific coin age cohort.

Despite the recent pullback due to profit-taking, other XRP on-chain data reveals that bullish sentiment remains prevalent in the market.

The XRP Market Value to Realized Value (MVRV) ratio, which assesses the average profit or loss of all holders, indicates that investors continue to hold onto profits of over 388%.

Most of the recent selling seems to have been driven by retail traders, as larger holders have shown a tendency to accumulate more. This is illustrated in the chart below, which reveals that investors with between 1M – 10M XRP increased their holdings by 260 million XRP tokens over the week.

In addition, Santiment data indicates that whale transactions (over $1M) reached a five-year high this past week.

However, the Age Consumed metric, which tracks the movement of previously idle coins based on their quantity, remained at low levels, and whale holdings did not decrease.

This suggests that the majority of whale activity this week was likely focused on accumulation. When larger holders keep their tokens during a bull market, it implies they believe there’s still potential for prices to rise.

It’s also crucial to point out that many new XRP whales emerged after the U.S. presidential election. This group might panic-sell if XRP prices drop close to their purchase price.

Moreover, XRP’s weekly active addresses have continued to rise, reaching a sixteen-month peak of 495K.

Meanwhile, David Schwartz, Chief Technology Officer of Ripple Labs, expressed optimism at The Emergence conference this Friday regarding the potential launch of the RLUSD stablecoin before year-end. Although the crypto community was hoping for a launch on Wednesday, Ripple dispelled rumors of any imminent release this week.

For XRP to initiate a rally towards a new all-time high, it must first surpass the $2.92 level. XRP recovered the 23.6% Fibonacci (Fib) Retracement level after momentarily dropping below it earlier in the week.

If XRP successfully reclaims the $2.58 level, it may retest the $2.92 level where it faced resistance.

A breakthrough above this level could enable XRP to achieve the maximum profit target of a multi-year rounded bottom by surging past its all-time high of $3.4 to establish a new record at $3.57.

The Relative Strength Index (RSI) indicates that the market is overheating as it sits in the overbought territory, signaling a possible correction. The Stochastic Oscillator is also in the overbought range but is trending downwards, indicating a decrease in bullish momentum.

A weekly candlestick close below the $1.96 level, near the 50% Fib Retracement, would invalidate the bullish outlook and lead XRP to seek support near the 61.8% Fib level.

XRP Could Serve as Strategic Weapons for the US

Anders proposes that the United States could utilize Ripple’s knowledge in cross-border payments and its influence on XRP to establish itself as a leading force in the finance and cryptocurrency industries.

The well-known digital asset researcher made this claim in a recent post on X, highlighting that the U.S. government could employ Ripple and XRP as strategic assets.

Trump Aims to Position the U.S. as the Global Crypto Hub

It is worth noting that during his campaign, Donald Trump pledged to transform the United States into the world’s crypto capital. To achieve this objective, the President-Elect indicated several initiatives he would implement once in office.

These plans include creating a national Bitcoin reserve, appointing a Crypto Czar to promote fair and transparent regulatory practices for the sector, and ensuring that anti-crypto lawmakers are kept away from the asset.

Although he has not yet taken office, Trump has already initiated significant steps to realize his campaign commitments, such as naming David O. Sacks as the crypto czar.

Ripple Holds Strategic Significance for the U.S.

With Trump’s inauguration set for January 20, Anders argued that Ripple is crucial for the United States in its quest to become a global leader in finance and cryptocurrency. He pointed out three key reasons to support this assertion.

Ripple’s Payment Solution

The expert noted that Ripple has created an advanced business-to-business (B2B) framework for cross-border payments. He emphasized that Ripple, based in the U.S., oversees this innovative payment method, potentially providing the nation with a competitive advantage in the field.

Upcoming Launch of RLUSD

Moreover, Anders mentioned that Ripple’s forthcoming stablecoin, RLUSD, could enhance USD adoption within global financial institutions. It is important to note that Ripple is currently seeking regulatory approval from the New York Department of Financial Services (NYDFS) to launch the stablecoin on the mainnets of Ethereum and XRP Ledger (XRPL).

Upon its launch, the Standard Custody & Trust Company will issue the stablecoin on Ripple’s behalf to various exchanges for public access. Additionally, Ripple plans to integrate the stablecoin into its payment solutions, enabling clients to utilize it alongside XRP for international settlements.

Ripple’s Holdings of XRP

Furthermore, Anders pointed out Ripple’s substantial ownership of XRP as another instrumental advantage for the United States. The expert noted that Ripple controls approximately 45% of XRP’s total supply, making the U.S.-based firm the largest holder of XRP.

He emphasized the significance of this position in light of one of Trump’s campaign promises, which includes supporting all U.S.-based cryptocurrency firms and tokens.

In summary, the U.S. could harness Ripple’s innovative payment system, its XRP holdings, and its upcoming stablecoin as strategic tools to sustain its dominance in the crypto and finance sectors.

The XRP community has reignited conversations about Ripple’s potential long-term objectives and how these might affect XRP’s price forecast.

According to the host of Common Sense Crypto (CSC), Ripple’s true ambitions may extend well beyond cross-border payments. Although these ideas are speculative, they have sparked discussions, particularly regarding Codius, Ripple’s inactive smart contract platform.

Speculation Regarding Ripple’s Genuine Agenda

Recently, the CSC host reignited interest in Codius with suggestions that Ripple has always aimed for objectives beyond just cross-border payments.

According to this market analyst, Ripple is preparing to oversee the entire derivatives market—an arena that deals with trillions of dollars in transactions each day.

This speculation arises from recent events, notably Ripple’s acceptance into the International Swaps and Derivatives Association (ISDA) last August. Additionally, crypto exchange Bitstamp has recently encouraged Ripple to participate in the development of a derivatives exchange.

The CSC host referenced a controversial figure in the XRP community, Kendra Hill, who previously suggested that cross-border payments were merely a testing phase for Ripple.

According to this theory, Ripple may have been secretly preparing for a broader application all along. Hill suggested that Ripple has not publicized these plans because the company was not yet ready. She indicated that the crucial element was Codius.

The Potential of Codius and Its Inactivity

Codius, designed by former Ripple employee Stefan Thomas, was introduced by the blockchain payment company as a smart contract platform back in 2014.

In contrast to Ethereum’s blockchain-native approach, Codius aimed to facilitate interoperability across blockchains, enabling developers to connect with various blockchain networks and external data sources.

However, despite its promise, Ripple ultimately halted the development of Codius. The platform was set aside as Ripple chose to focus on other projects, primarily emphasizing cross-border payments, which have become the cornerstone of Ripple’s business strategy.

Smart Contracts on the XRP Ledger

Interestingly, the host of CSC suggested that Codius was pushed aside because the inclusion of smart contracts would have increased the costs of Ripple’s payment solutions, making it harder to compete with SWIFT.

Nonetheless, he implied that Ripple might be reconsidering the integration of smart contracts as a fundamental aspect of its strategy, particularly with the ongoing development of an Ethereum Virtual Machine (EVM) sidechain for the XRP Ledger (XRPL).

The EVM sidechain enables developers to implement Ethereum-based smart contracts on the XRP Ledger, effectively combining XRP’s rapid transaction speeds with Ethereum’s programming functionalities. Ripple recently announced intentions to investigate native smart contract capabilities on the XRPL in conjunction with the EVM sidechain.

While the EVM sidechain is still under development, the potential for comprehensive smart contract features on the XRPL could be significant. Some analysts contend that if the XRPL successfully incorporates these capabilities, XRP’s price could soar, possibly reaching the “four to five digits” range as speculated by CSC’s host.

However, it’s essential to acknowledge that these notions remain speculative, as there is no concrete evidence supporting them, given that Ripple has not publicly indicated such plans.

Disclaimer: This content is for informational purposes and should not be construed as financial guidance. The opinions expressed in this article may include the author’s personal views and do not necessarily represent The Crypto Basic’s opinion. Readers are advised to conduct thorough research before making any investment decisions. The Crypto Basic is not liable for any financial losses.

How the Ripple RLUSD Stablecoin Could Propel XRP Prices

A market analyst has recently discussed how the upcoming Ripple stablecoin, RLUSD, might positively impact XRP prices.

Ripple’s RLUSD stablecoin is expected to launch by the end of this month, contingent on regulatory approval from New York officials. Although there were reports of a launch a few days ago, Ripple has clarified that it is still awaiting the necessary approvals.

In the meantime, speculation surrounding RLUSD has sparked conversations about its potential influence on XRP, with market observer Lakeita Powell recently sharing theories about how this development could affect its price trajectory.

RLUSD as a Stable Medium for Transactions

The analysis pointed out that a significant benefit of RLUSD is its capacity to reduce volatility during XRP transactions. Typically, institutions and banks convert fiat currencies, such as the US Dollar, to purchase XRP.

These transactions can be vulnerable to currency fluctuations, adding complexity and risk. However, utilizing RLUSD as a stable intermediary allows institutions to make large-scale XRP purchases without the concern of abrupt value changes.

Boosting XRP Liquidity and Clearing Order Books

The theory further highlighted RLUSD’s ability to improve liquidity within the XRP market. Large-scale purchases of XRP using RLUSD could significantly clear portions of exchange order books.

For instance, if a bank deposits $1 billion in RLUSD and subsequently uses it to acquire XRP, the stablecoin could systematically eliminate sell orders at lower price levels. This activity would push the price upwards as lower-priced XRP becomes scarce, driving the market toward higher valuation levels.

Interestingly, this situation could result in a rapid rise in XRP prices, particularly if institutions place large buy orders. The exhaustion of available cheaper XRP leads to increased demand, setting higher baseline prices in the order books.

As XRP prices increase, the utility and demand for the asset remain consistent due to its inherent advantages, such as speed and cost efficiency for cross-border payments.

Notably, RLUSD would facilitate these transactions, providing a stable mechanism to bolster ongoing XRP adoption. This development could encourage greater institutional use of XRP, thus supporting demand and price growth.

Example Scenario

In the analysis, the commentator illustrated a specific scenario that exemplifies this theory. Remarkably, in this scenario, a bank deposits $1 billion into RLUSD, maintaining it in an exchange or a Ripple-supported wallet.

Subsequently, the bank employs RLUSD to purchase XRP. Starting with lower-priced orders, it significantly clears the order book, driving the price from $0.50 to $5 or more. Nevertheless, as XRP currently trades at $2.4, these buys could initiate above $2 and continue to rise from that point.

Once XRP attains higher price levels, these figures set a new baseline as the lower-priced supply is depleted. Furthermore, the bank would utilize XRP for international transactions. RLUSD continues to serve as the stable medium for these operations, ensuring the system’s efficiency.