Bitcoin has led to the development of a whole sector involving crypto exchanges, digital wallets, and trading applications, capturing the interest of U.S. presidents and major financial institutions worldwide.

This Friday will mark the 16th anniversary of bitcoin, the first cryptocurrency ever created.

Developed by the anonymous figure Satoshi Nakamoto on January 3, 2009, bitcoin has evolved from a niche project among cryptographers to become the seventh most valuable asset in the world, boasting a market capitalization of nearly $2 trillion.

It has created thousands of millionaires, several billionaires, and caused life-altering losses for others. Moreover, bitcoin has inspired more than 10,000 alternative cryptocurrencies and has given rise to an entire ecosystem of crypto exchanges, digital wallets, and trading apps.

As bitcoin celebrates its Sweet 16, it’s worth examining how it reached this point and what the future of cryptocurrency might look like.

The inception of bitcoin and the concept of cryptocurrency emerged as a response to the financial crisis of 2008, with the very first block of bitcoins featuring a headline from that day’s issue of The Times: “Chancellor on brink of second bailout for banks.”

Nakamoto’s invention presented a new option outside the realm of traditional finance, one that didn’t depend on banks or governments for its supply control. A white paper describing bitcoin framed it as a “peer-to-peer electronic cash system” utilizing a network of computers to maintain a public ledger known as a blockchain.

This blockchain, which transparently monitors bitcoin’s supply, offers an unchangeable record of the digital currency’s transactions that no single person or organization can control or modify. It additionally serves as the foundational technology for all other cryptocurrencies.

Bitcoin’s decentralized nature allows it to be transacted globally, needing only an internet connection for any transactions anywhere in the world. While its intended purpose was to democratize finance, its somewhat anonymous aspect led to early adoption by individuals who used it for illicit transactions, such as buying and selling drugs on the dark web.

Despite its rebellious origins, bitcoin’s increasing popularity has caught the attention of the very traditional institutions it initially set out to challenge.

The recent bull market, which has propelled bitcoin from under $20,000 to over $100,000 in just 18 months, has been driven by demand from institutional investors.

In early 2024, U.S. regulators sanctioned the introduction of the first bitcoin spot exchange-traded fund (ETF), allowing access to hundreds of billions of dollars from previously unengaged investors.

The significant decision made by the U.S. Securities and Exchange Commission (SEC) was celebrated as a “historic” milestone for the cryptocurrency sector and pushed bitcoin to achieve new all-time high prices. It also sparked speculation about the SEC approving spot ETFs for other major cryptocurrencies, which finally happened in July for Ethereum, the second most valuable cryptocurrency.

That same month, Donald Trump made history by being the first U.S. presidential candidate to actively engage with the crypto industry. His appearance at the Bitcoin 2024 conference in Nashville triggered a price increase that continued to rise after his election victory in November.

Trump has vowed to establish America as the “bitcoin superpower of the world” upon assuming office in January, and he has already selected a pro-crypto candidate to lead the SEC. The incoming president has also promised to create a crypto advisory council and establish a bitcoin strategic reserve from the assets seized from cybercriminals.

The support from influential politicians and established financial institutions has played a crucial role in legitimizing bitcoin and other cryptocurrencies while simultaneously driving up their prices.

What purposes does cryptocurrency serve? And why are there so many variants?

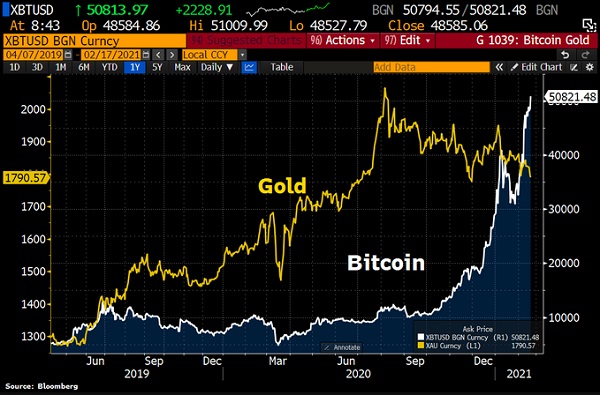

Bitcoin’s ongoing price fluctuations—often swinging by 10% or more each month—render it impractical for day-to-day transactions. Instead, investors have compared it to a form of “digital gold,” given its limited supply and propensity for long-term value appreciation, making it a favored store of value. In December, BlackRock, the world’s largest asset manager, recommended that investors allocate 2% of their portfolios to bitcoin.

Other cryptocurrencies have developed that are better suited for transactions, either because of reduced transaction costs, less price volatility, or an engaged user community. The meme-based cryptocurrency Dogecoin, launched in 2013, has unexpectedly emerged as a currency accepted by significant retailers like Microsoft, Tesla, and Twitch. Its popularity, practicality, and low fees have even prompted tech billionaire Elon Musk to propose that it could eventually become the “currency of the internet.”

Of the over 10,000 cryptocurrencies currently available, most were created with the aim of providing something distinctive. Some offer enhanced privacy, making it untraceable for transactions or users, while others utilize blockchain technology to facilitate platforms for smart contracts and non-fungible tokens (NFTs).

The influx of capital into the cryptocurrency market has inevitably drawn in scammers and cybercriminals, aided by a regulatory framework that is still adapting to such a new technology. However, with the recent interest from the new U.S. administration and the world’s largest financial institutions, the spectacular growth of cryptocurrency appears poised to persist.

Bitcoin stands out as the most commonly traded and recognized form of cryptocurrency.

Since its inception in 2009, bitcoin’s value has seen drastic fluctuations, often dramatically, as public awareness and interest in digital currency evolve.

Over the past decade, bitcoin’s value has undergone notable volatility, marked by significant increases followed by sharp declines. In 2017, the price of bitcoin skyrocketed from approximately $1,000 in January to nearly $20,000 by December. In 2018, the trend reversed, causing prices to fall below $4,000. The year 2020 brought yet another dramatic shift, with its value varying between $7,000 and exceeding $28,000 by year’s end. The rising trend continued into 2021, culminating in bitcoin reaching an all-time high of $69,000 in November.

Then, in 2022, bitcoin’s value, along with that of other cryptocurrencies like ethereum, saw a significant downturn during what is referred to as the crypto winter. By the end of that year, bitcoin’s price had dropped below $20,000. Nevertheless, 2023 brought a resurgence, ending the year with bitcoin priced at just over $42,000.

The year 2024 has marked a significant milestone for Bitcoin, driven by various crucial events that propelled its price upward. In January, the U.S. Securities and Exchange Commission (SEC) authorized the creation of cryptocurrency exchange-traded funds, including spot bitcoin ETFs. By March, bitcoin’s trading price reached approximately $70,000. An additional bitcoin halving occurrence in April 2024 also spurred interest and increased its value.

As the U.S. presidential election approached, bitcoin was valued at around $68,000 in October 2024. Following the election, bitcoin entered a bull market, achieving new heights nearly every day. On November 13, 2024, bitcoin set a new record, soaring above $90,000, resulting in a staggering market capitalization of about $1.8 trillion USD.

What is driving the increase in bitcoin’s price?

The surge in bitcoin’s value seen in November 2024 can be attributed to multiple factors, each playing a vital role in its ascent.

However, the most significant factor is the election of President Trump in the U.S. general election on November 4. Trump’s win has served as a crucial catalyst for bitcoin’s remarkable price surge.

During his campaign, at a bitcoin conference held in Nashville, Tennessee, Trump vowed to establish the U.S. as “the crypto capital of the planet.” At that same event, he committed to appointing a cryptocurrency-friendly chairperson to the SEC if he were to win.

The vision under a Trump administration suggests a reduction in regulatory constraints on cryptocurrency and the introduction of policies that encourage usage and adoption.

To further support the push for more crypto-friendly policies, Trump has proposed the creation of a presidential advisory council focused on bitcoin and cryptocurrencies. This council would consist of individuals who advocate for cryptocurrency. Additionally, Trump has stated his intention to prevent the U.S. Federal Reserve from issuing its own digital currency.

Trump’s favorable stance on cryptocurrency and the overall rhetoric from his administration have rekindled confidence and excitement in bitcoin’s price. His victory also triggered a general surge in U.S. stock markets in the aftermath of the election.

Continued inflows into ETFs

The Trump victory added more momentum for bitcoin, on top of a succession of other contributing factors.

In January 2024, the SEC approved the launch of spot bitcoin ETFs. The arrival of Trump on the political scene heightened the popularity of these ETFs, resulting in a substantial influx of new investor capital.

On November 11 and 12, bitcoin ETFs experienced their highest recorded capital inflows since they were approved in January, with about $2 billion pouring into them on those two days alone.

The BlackRock iShares Bitcoin Trust has been one of the primary beneficiaries of these inflows, accumulating over $40 billion since its inception, outpacing any other ETF introduced in the past ten years.

Deregulation

It is anticipated that the technology sector will face reduced regulation under a Trump-led administration.

This anticipated deregulation could significantly impact the cryptocurrency landscape. Even discussions surrounding deregulation have already contributed to price increases for bitcoin in November. The prospects for deregulation under Trump’s presidency have already pushed bitcoin prices to record levels exceeding $90,000, reflecting market optimism for a crypto-friendly regulatory environment.

As part of his campaign agenda, Trump indicated plans to lessen regulations on the cryptocurrency sector. A decrease in regulation could present more opportunities for cryptocurrencies by imposing fewer limitations.

Trump’s particular promises regarding regulations encompass the following:

- Removing SEC Chairman Gary Gensler, who has overseen crackdowns on the cryptocurrency sector.

- Establishing a strategic reserve of bitcoin for the United States.

- Transforming the U.S. into “the cryptocurrency capital of the world.”

- Designating cryptocurrency-friendly individuals to key financial regulatory positions.

- Reducing taxes.

- An additional component of Trump’s agenda that is contributing to bitcoin reaching all-time high prices is the tax issue.

Several aspects of Trump’s plans aim to decrease taxes and enhance the attractiveness of cryptocurrency investments for investors. Some proposed tax modifications and their potential effects on the cryptocurrency market include the following:

- A reduction in the capital gains tax rate. Trump has suggested lowering maximum capital gains tax rates. This cut would enable investors to retain a larger share of their earnings from cryptocurrency transactions.

- Tax-exempt transactions. Trump’s proposals have also included the notion of eliminating capital gains taxes on cryptocurrencies that are produced in America, specifically bitcoin and XRP. In contrast, Ethereum, which largely operates outside the U.S., would remain subject to taxation.

Increased participation from retail investors.

When bitcoin first emerged, it was challenging for typical retail investors to get involved. This situation has changed. As more individuals grow accustomed to digital assets, the user base for bitcoin and other cryptocurrencies is continuously expanding, which drives up demand and prices.

There are now various methods for retail investors to engage in the cryptocurrency market:

- Cryptocurrency exchanges. Platforms like Coinbase have allowed a growing number of retail investors to participate.

- Cryptocurrency ETFs. Any retail investor can now easily invest in bitcoin through a cryptocurrency ETF. However, access to this type of investment in bitcoin did not exist before 2024.

Effects of other cryptocurrencies.

Bitcoin is not the only cryptocurrency experiencing a rise in value. Several other cryptocurrencies, including Ethereum, Solana, and even Dogecoin, have also seen significant increases.

The future of cryptocurrency.

The forecast for cryptocurrency seems predominantly positive, though some uncertainties persist.

Trump’s supportive stance on cryptocurrency, which includes plans for a national bitcoin reserve, backing U.S.-based mining, and hindering the introduction of a central bank digital currency, may enhance the cryptocurrency market. His commitment to position the U.S. as the “crypto capital” of the globe could draw in international innovators and investors.

While the immediate market reaction has been favorable, with substantial gains for bitcoin and other cryptocurrencies, the long-term effects will hinge on the actual implementation of these policies and broader economic conditions. The schedule for putting Trump’s policies into effect remains unclear.

Although the U.S. is a significant market, the worldwide regulatory environment for cryptocurrencies is continually evolving, which could influence the U.S. market, irrespective of domestic regulations.

Challenges of Bitcoin

As bitcoin gains popularity as a payment method, the existing system is struggling to handle the volume of transactions, resulting in higher transaction fees. The blocks that make up the transactions are restricted to a size of one megabyte, which has caused delays in processing. Recently, a disagreement arose within the bitcoin community regarding how to manage the growing adoption, leading to a “fork” on August 1, which created a new currency—bitcoin cash. Bitcoin cash is fundamentally a replica of the bitcoin blockchain, but it features an increased block size of 8 megabytes. Individuals who had bitcoin before the split now possess an equal amount of both bitcoin and bitcoin cash.

Nevertheless, a significant criticism regarding the widespread acceptance of bitcoin as a payment method is its extreme price fluctuations. While major fiat currencies like the dollar and euro do experience variations, bitcoin’s volatility is approximately 30 times greater than typical foreign exchange markets, which means it can rise or fall rapidly.

Recent reports about China shutting down several bitcoin exchanges triggered a spike in bitcoin volatility and a wave of panic selling. As reported by the New York Times, regulators were increasingly worried about the potential risks that cryptocurrencies could pose to China’s financial system. This news resulted in a sharp decline in bitcoin’s price, demonstrating that regulatory actions regarding cryptocurrencies will continue to significantly influence pricing volatility in the future.

In spite of these issues, advocates argue that we are still at an early stage in the adoption of bitcoin; they believe that as acceptance grows and regulatory stances become clearer, the price volatility will eventually stabilize.

Ethereum, ICOs, and Other Cryptocurrencies

One of the primary obstacles to bitcoin’s long-term viability could be its inherent limitations. Bitcoin was intentionally designed with restricted flexibility to ensure robust security. It has essentially evolved into a complex store of value or a method for making payments—but little more than that. Consequently, it is quite difficult for external developers to create applications on the bitcoin blockchain. This is where ethereum comes into play.

Ethereum, currently the second-largest cryptocurrency in the world, was created by Vitalik Buterin a few years ago. Buterin, now 23, started in bitcoin development but sought to establish a more advanced and adaptable blockchain. His brilliance is reflected in his devoted following within the cryptocurrency community.

Like bitcoin, ethereum operates on its own blockchain, but it allows developers to create applications that run on it. These applications utilize “smart contracts,” which can be regarded as a type of programmable money. For instance, if someone wishes to engage in a more complex transaction—such as purchasing a home or acquiring a business—they could do so with ethereum, eliminating the need for a trusted intermediary, like a real estate agent or attorney, to finalize the agreement.

Buterin envisions ethereum as “the world computer” in a future where traditional centralized applications that depend on trusted parties are instead built in a decentralized way on ethereum. He likened his creation to “the smartphone of blockchains” in a report he authored for R3, a financial innovation consortium. He referred to ethereum as “a universal platform where, whatever you want to build, you can just build it as an ‘app,’ and [e]thereum users will benefit from it immediately without having to download any new special software.”

Ethereum also facilitates the generation of “tokens” for applications developed on its network. These tokens have been issued to the public through a novel fundraising method known as an Initial Coin Offering, or ICO. Typically, these tokens do not confer any form of ownership in a specific project, but they enable individuals to speculate on the potential future adoption of these systems.

The tremendous surge in interest surrounding ICOs has been astonishing, with numerous projects launching weekly, some lacking any clearly defined business model, catching the attention of the SEC. William Mougayar, a venture advisor and ICO expert, best summarized his apprehension regarding their growing popularity when he remarked to bitcoin news site CoinDesk: “Yes, I want the ICO party to continue, but I’m seeing participants that are just there for the ride. I’m seeing companies and ideas getting ICO-funded on a wing-and-a-prayer chance of being successful. . . . When the party gets overcrowded and unwanted visitors want it louder and bigger, events can turn unpredictable.”

As concerns about integrity, security, and volatility continue to affect the networks that support them, cryptocurrencies face a challenging future. Despite these hurdles, significant advancements have been made to establish more secure environments that facilitate the exchange of digital currencies. With increased adoption and ongoing investment in the sector, the potential remains limitless.