Bitfinex analysts stated that heightened institutional adoption of Bitcoin will generate significant demand-side pressure, resulting in short-lived price dips in 2025.

According to Bitfinex analysts, Bitcoin price drops will be brief in 2025 due to strong institutional demand, with predictions suggesting a best-case scenario where Bitcoin could double in price by June 2025.

In a market report dated Dec. 17, Bitfinex analysts noted that their minimum price forecasts “stand at $145,000 by mid-2025, potentially reaching $200,000 under favorable conditions.”

Volatility in Bitcoin pricing is anticipated during the first quarter.

The analysts expressed that any price corrections in 2025 will likely be minor, thanks to institutional inflows. They observed that while Bitcoin may experience volatility in Q1 2025, the overall trend points to continued price appreciation, fueled by ongoing investments into spot Bitcoin exchange-traded funds (ETFs) and greater institutional and global acceptance.

Since their inception in January, approximately $36 billion has flowed into spot Bitcoin ETFs in the United States, as reported by Farside Investors.

“The BTC ETFs have become one of the largest groups of Bitcoin holders, accumulating over 1.13 million BTC,” the analysts remarked.

At the time of their report, Bitcoin was trading at $105,360. Nic Carter, a partner at Castle Island Ventures, mentioned this price could increase nearly ninefold in the long term.

“Looking at the long term, I believe Bitcoin could eventually match gold’s market cap, which would value Bitcoin at $900,000,” Carter told Bloomberg Television on Dec. 17.

On Dec. 16, Bitcoin author Andy Edstrom noted that he is “struggling to get accustomed to the fact that $1,000 represents less than a 1% change in Bitcoin’s price.”

Bitfinex analysts indicated that if Bitcoin follows a pattern similar to the 2021 cycle, with an approximate 40 percent increase above its moving averages, it could potentially “climb to around $339,000.”

“In a less likely scenario, if the extended 2017 cycle were to repeat with similar diminishing returns, Bitcoin might peak around $290,000 by early 2026,” they stated.

The introduction of a strategic Bitcoin reserve by the incoming Trump administration may alter the market narrative.

Crypto analyst Tyler Durden remarked on Dec. 17 in an X post, “If a single country establishes a Bitcoin strategic reserve, the concept of your four-year cycles will be obsolete.”

Following Donald Trump’s election win on Nov. 5, pro-crypto Senator Cynthia Lummis announced plans to advance legislation for the US government to acquire Bitcoin and hold it for a minimum of 20 years.

The future of stablecoins appears promising in 2025 as massive growth and widespread acceptance are set to drive the asset class forward.

The stablecoin market is anticipating exceptional advancements and milestones as it concludes 2024. What can we expect in 2025? Even greater achievements as mass adoption takes hold.

However, before considering the future, we must reflect on what we are leaving behind.

In 2024, the stablecoin market has continued the trends established in prior years. Prominent issuers like Tether and Circle explored stablecoins linked to currencies other than the US dollar, but uptake has been sluggish.

Stablecoins backed by the euro remain a niche market with relatively low capitalizations, and even major entrants have struggled in this space.

The market has shown a definite preference for Tether’s USDT and Circle’s USD Coin, with minimal interest in new alternatives. This reluctance may stem from the memories of past failures, such as the 2022 collapse of Terraform Labs and its TerraUSD (UST) stablecoin, which led to significant financial losses for many. The fallout damaged trust in algorithmic and decentralized stablecoins, and their market share remains small compared to USDT and USDC, although they still have a dedicated following.

Overall, 2024 has been quite favorable for the cryptocurrency sector, with Bitcoin surging to $100,000, the development of regulatory frameworks worldwide, and traditional financial entities cautiously entering the market. The total issuance of stablecoins has continued to increase, breaking new records along the way. In Singapore, stablecoin transactions reached a value of $1 billion, and their utilization is expected to keep on rising globally.

Looking ahead, here are four forecasts for the stablecoin market in 2025.

The issuance of regulated stablecoins is expected to rise.

In 2025, we can anticipate a greater number of stablecoins launched by financial institutions. Tether has already proven the viability of this model by generating $5.2 billion in profit during the first half of 2024 through investments in US Treasury bonds.

The strategy is straightforward: 1) Create a regulated stablecoin, 2) partner with a well-known exchange for promotion, and 3) achieve steady yields by investing in fiat reserves. As part of the promotional effort, the exchange may waive fees associated with the stablecoin, attracting clients. This approach is too appealing for traditional financial institutions to overlook.

Banks are beginning to offer custody services

The implementation of the European Union’s Markets in Crypto-Assets (MiCA) regulation, slated for completion by January 2025, will act as a major driving force. MiCA mandates that stablecoin issuers obtain licenses while also establishing a clear structure for financial institutions to participate in the cryptocurrency market.

This regulatory clarity will facilitate banks in providing custody services, essential for merging cryptocurrency with traditional financial systems. Custody solutions allow banks to securely hold digital assets for their clients, catering to both institutional investors and cautious retail customers.

Market changes in Europe

Currently, there are worries regarding Tether’s USDT stablecoin. It is the market leader but does not comply with the required licensing for MiCA, and there are indications that exchanges might delist USDT for users in Europe. Should Tether fail to secure a license, it risks a significant loss of market share in the region. This situation could create opportunities for regulated alternatives like USDC, which has already received the necessary approvals in Europe.

MiCA’s guidelines may motivate local participants to create euro-backed stablecoins, fostering competition and potentially altering market dynamics away from dollar-centered options.

Expansion of stablecoins to local currencies

Another trend to observe in 2025 is the rise of stablecoins linked to local currencies. In 2024, the Central Bank of the United Arab Emirates sanctioned the introduction of the dirham-backed AE Coin stablecoin, claiming it will be the first stablecoin regulated by the central bank.

As local stablecoins gain popularity, they will be integrated into local banking systems as countries strive to digitize their economies.

The outlook for stablecoins by the end of 2025

The overall future of stablecoins appears bright. By 2025, the stablecoin market will not only expand but also evolve.

Stricter regulations, new participants, and wider acceptance will transition stablecoins from a specialized financial instrument to a mainstream asset class. Stablecoins will provide quicker, more affordable, and more inclusive financial services while being incorporated into traditional finance.

The year 2025 will mark the onset of widespread adoption. Previously, the market was largely led by semi-professional entities, but with MiCA’s introduction in Europe and the election of Donald Trump in the United States, a greater number of new entrants are expected. The market also anticipates friendlier regulations regarding cryptocurrencies.

The combined market capitalization of USDT and USDC could potentially double or even triple, with an expected expansion of the overall market size. Additionally, localized stablecoins will increasingly influence the market, which may challenge the dominance of the dollar and diversify the landscape.

USDC vs. USDT: Which of the two main stablecoins is a better choice?

Cryptocurrencies are recognized for their erratic price movements and can change in value quickly. This volatility poses challenges in using them as a reliable store of value or a means of exchange. To address this issue, stablecoins were introduced to provide price stability. These digital currencies are linked to stable assets like fiat currencies, commodities, or precious metals. Among these, USDC and USDT stablecoins are the most well-known examples in the cryptocurrency market, but what are they, and how do they stack up against each other? An analysis of USDC versus USDT reveals their distinct features and their roles in the cryptocurrency sector.

What are Fiat-Backed Stablecoins?

Fiat-backed stablecoins represent the most prevalent category of stablecoins. They are supported by reserves of fiat currency held in a banking institution. The quantity of underlying fiat currency kept in reserves should match the total number of stablecoins in circulation to ensure full collateralization. If the stablecoin is tied to the US dollar, it is termed a USD stablecoin.

Advantages of Stablecoins

Stablecoins provide numerous benefits, such as stable value, transparency, and high efficiency. These types of cryptocurrencies are adaptable, functioning as a dependable store of value, an efficient means of exchange, or a reliable unit of account. They are particularly advantageous for international payments, minor transactions, and remittances. Importantly, USDT and USDC stablecoins are notable for enabling quick and low-cost interactions and allowing users to earn interest through decentralized finance platforms.

Compared to traditional financial systems, stablecoins offer several unique benefits. Their decentralized nature allows for quick, low-fee global transactions without relying on traditional financial intermediaries like banks. This feature is especially attractive given the growing popularity of stablecoins on significant exchanges. Additionally, stablecoins enhance security as an investment choice due to being built on blockchain technology, which guarantees tamper-proof records of transactions and protects user funds. Furthermore, many stablecoins comply with regulatory standards and undergo regular audits, providing an extra level of confidence and reliability for users.

Why are there so many USD stablecoins?

The US dollar is the leading global currency, and numerous individuals and businesses worldwide utilize it for trade and commerce. USD stablecoins enable users to transact in USD without needing a conventional bank account. They also offer an efficient mechanism for transferring funds internationally, avoiding the costs and delays associated with traditional remittance services.

Stablecoins make it easy for users to transfer and store value across cryptocurrency platforms, presenting a safer alternative compared to the price fluctuations of cryptocurrencies like Bitcoin and Ethereum.

What factors make a stablecoin safe?

A stablecoin’s safety relies on various factors, including its reserve assets, the level of transparency from the issuer, and the regulatory environment in which it operates. A stablecoin supported by substantial reserves of a reputable fiat currency and audited by a trustworthy third party is generally considered safer than one backed by less-known assets or an unaudited reserve.

MiCA’s Impact on Stablecoin Safety

The EU’s Markets in Crypto-Assets (MiCA) regulation aims to establish a detailed framework for cryptocurrency and stablecoin regulation throughout Europe. It requires stablecoin issuers to acquire e-money licenses and comply with transparency and reserve management standards. MiCA ensures that only stablecoins meeting auditing and regulatory requirements can operate within the EU. This could positively impact USDC, which already adheres to stringent regulatory standards, while USDT might encounter more difficulties due to its past transparency issues.

What Is Tether (USDT)?

Tether (USDT) is the first and most recognized USD stablecoin, launched in 2014 with the intention of creating a connection between traditional fiat currencies and cryptocurrencies. It is pegged to the US dollar and is backed by a combination of fiat currency and other assets. Tether holds the distinction of being the most utilized stablecoin, with a market capitalization exceeding $70 billion.

USDT Stability

In 2017, Tether experienced a security breach, resulting in the loss of 31 million USDT tokens. The project faced criticism as it appeared to evade responsibility and accountability, opting instead for an “emergency hard fork” to protect its reputation.

In 2017, Tether faced a hack that led to the loss of 31 million USDT. Rather than accepting responsibility, they chose to react with an “emergency hard fork” to mitigate reputational damage. This situation drew scrutiny from the New York Attorney General when it was revealed that Tether had been using its cash reserves for lending without adequately backing its tokens with USD. Instead of responding to the inquiry rationally, they attempted to deflect the blame onto the Attorney General.

USDT Volume

As per CoinMarketCap, the current market cap of USDT is roughly $111 billion, making it the most commonly used stablecoin globally. This positions Tether as the third-largest crypto asset by market cap, following Bitcoin and Ethereum.

What Is a USD Coin (USDC)?

USDC, also known as USD Coin, ranks second among the most popular stablecoins. It was introduced in 2018 by Circle, a financial technology firm based in Boston.

The management and issuance of USDC are handled by the Centre consortium, which includes Circle and Coinbase. Centre is the sole entity with control over the supply of USDC, similar to how the Federal Reserve manages the supply of USD. Nonetheless, a significant difference lies in the fact that Circle has complete control over USDC, which is not the case with USD and the Federal Reserve.

USDC Stability

USDC is regarded as more transparent than USDT due to Circle providing monthly audits of its reserve assets. Moreover, USDC is under the regulation of the US Securities and Exchange Commission (SEC).

In March 2023, Circle disclosed that $3.3 billion of the cash reserves backing USDC tokens were stored in Silicon Valley Bank, which led to a depegging and a drop in value against the dollar to 87 cents. Similarly, other dollar-backed stablecoins like DAI and USDD also experienced a depegging from their original $1 value. However, USDC managed to regain its peg in just two days.

USDC Market Capitalization

According to CoinMarketCap, USDC’s current market capitalization exceeds $34 billion, making it the second most utilized stablecoin worldwide after USDT.

Tether vs USDC: Comparative Analysis

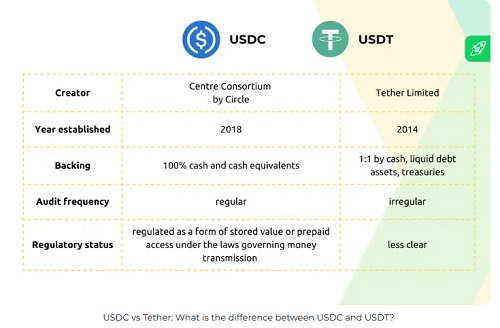

Analyzing the distinctions between Tether and USD Coin can be insightful. While both are stablecoins, they possess several differing key characteristics and should be reviewed before making an investment. Let’s begin by exploring the similarities they share.

They are both stablecoins.

USDC and Tether are nearly indistinguishable aside from their market capitalization. Both Tether and USD Coin are stablecoins that have a fixed value pegged to the US dollar. This peg makes them less volatile compared to other crypto assets, enabling them to act as a store of value or a medium of exchange. However, they cannot replace the US dollar perfectly, as they cannot be deposited in traditional bank accounts or used for various payments.

One-to-one (1:1) value ratio with USD.

Both Tether and USD Coin sustain a one-to-one value ratio with the US dollar. This signifies that for each USDT or USDC token that is issued, there exists a corresponding US dollar held in reserve.

Blockchain variation.

Initially, both Tether and USDC operated solely on the Ethereum blockchain, but they have since gained representation across multiple blockchains, facilitating rapid transfers and reduced transaction fees.

Blockchain transparency.

Both Tether and USD Coin offer transparency regarding their blockchain transactions, allowing users to track their transactions and ensure they are receiving what they paid for.

Rapid transferral.

USDT and USDC can both be transferred swiftly and effortlessly, making them well-suited for peer-to-peer transactions and remittances.

USD Coin vs Tether: What are the Key Differences?

Tether (USDT) and USD Coin (USDC) rank as two of the most popular stablecoins within the cryptocurrency domain. Even though both stablecoins share similarities, they also have notable differences.

Launch date.

Tether was introduced in 2014, whereas USD Coin was launched in 2018. This indicates that Tether has been in the market longer and has had an extended period to establish itself.

Reserve Assets.

Both Tether and USD Coin are backed by a reserve of assets, including fiat currencies and other financial instruments. However, concerns have been raised regarding the stability and transparency of Tether’s reserves, as the company has faced allegations of using unbacked reserves to support its stablecoin value.

As of 2024, Tether (USDT) is primarily supported by U.S. Treasury Bills and other assets. According to Blockworks, about 58% of Tether’s reserves are in U.S. Treasuries, with the remaining reserves comprising cash and cash equivalents (approximately 9%), secured loans (around 9%), and various investments, such as cryptocurrencies, corporate bonds, funds, and precious metals. This diversified backing has led to scrutiny and calls for enhanced transparency and regulation.

Conversely, USD Coin (USDC) is supported by a more straightforward reserve strategy, primarily made up of cash and short-term U.S. Treasuries. Approximately 75.6% of USDC’s reserves are held in U.S. Treasuries, while 24.4% are in cash at regulated financial institutions. Circle, which issues USDC, ensures adherence to financial regulations by keeping these reserves with regulated financial institutions.

Circle has built public trust by maintaining a solid reputation and providing comprehensive disclosures about its reserve assets, while Tether continues to experience controversy due to its perceived lack of clarity and centralized regulation. Tether’s transparency issues have been emphasized by its omissions concerning the specific composition of its reserves.

MiCA Compliance: USDT vs. USDC

According to MiCA, stablecoin issuers are required to secure e-money licenses to function within the EU. This regulatory structure could significantly influence Tether (USDT), as it encounters difficulties in sustaining market access due to issues regarding transparency and reserve management. Conversely, USDC, which has set compliance measures and frequent audits, is in a stronger position to align with MiCA’s stringent requirements. Consequently, European exchanges may prioritize USDC over USDT, impacting liquidity and market share in the area.

Trade/liquidity volume

Tether (USDT) regularly shows a greater market capitalization and trading volume in comparison to USD Coin (USDC). As reported by CoinMarketCap, USDT’s daily trading volume hovers around $50 billion, drastically outpacing USDC’s $5 billion in daily trade—approximately tenfold greater. This noteworthy disparity in liquidity and transaction volume renders Tether a more favored stablecoin among traders and investors, as it provides greater accessibility and market activity.

USDC vs USDT: Concluding Thoughts

Stablecoins play a critical role in the cryptocurrency ecosystem, acting as blockchain-based tokens with a fixed value linked to fiat currency. These stable tokens enable users to effortlessly transfer and retain value across diverse crypto platforms without the risks associated with price volatility typical of digital assets like Bitcoin and Ethereum. USDT, USDC, and BUSD (Binance USD) constitute the majority of the stablecoin sector’s market capitalization, making them prime selections for investors interested in entering the stablecoin market.

In summary, although both Tether and USD Coin aim to maintain a 1:1 value ratio with the US dollar, notable differences exist between the two. Tether boasts a longer track record and a higher trading volume, yet has encountered some controversies regarding the reliability of its reserve assets. In contrast, USD Coin has been more forthcoming about its reserve holdings, though it exhibits a lower trading volume. Ultimately, the decision between Tether and USD Coin will depend on the specific needs and preferences of the user.