The intricacy of executing global payments remains a continual challenge for multinational companies across the globe. After many years of manual operations, technology is now reshaping how businesses transfer funds internationally—from overseeing various banks and currencies to facilitating compliant, timely transactions.

As the Senior Vice President of Product at Papaya Global, which processes payments in 160 countries, we’re not merely witnessing this change—we are at the forefront of it.

In the United States, organizations already utilize seamless domestic payroll with consolidated vendor solutions. However, global workforce payments still lag behind.

The imminent advancement in payment technology will revolutionize cross-border operations, delivering equivalent efficiency worldwide through a unified solution for both calculations and payments.

Firms that adopt this transformation will achieve notable competitive benefits in operational effectiveness, cost reduction, and global scalability.

What can we expect in 2025? Let me get straight to the point—in this next segment, I will highlight five transformative trends in global payments and explain how companies can position themselves to lead this transition.

Trend 1: The emergence of real-time cross-border payments

Historically, processing international payments has entailed intricate clearing systems and unavoidable delays. The European Union’s new Instant Payments Regulation is set to change this dramatically – by October 2025, all eurozone payment providers are required to support instant payments. This marks a significant shift in global payment expectations.

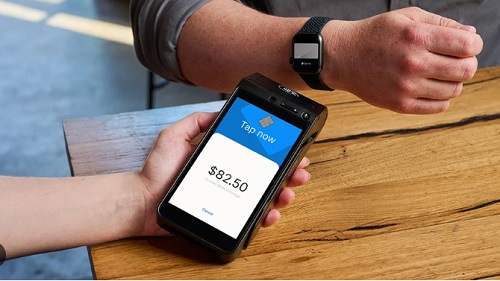

This evolution also includes modern payment methods that are becoming increasingly popular among employees. Digital wallets and payment cards are quickly becoming standard options, allowing immediate access to funds no matter the location. These solutions offer the same immediacy as local payments while adding flexibility to how employees receive and use their earnings.

Impact on business operations:

- Payments reach you on the same day rather than next week.

- There’s no longer any uncertainty about when funds will clear.

- Every transaction takes on the same speed as a local transfer.

- Teams can concentrate on growing the business rather than tracking payments.

Strategic priorities:

- Identify the points where your payments are delayed today.

- Seek out partners who already facilitate instant international payments.

- Ensure your systems can accommodate quicker processing times.

- Begin making changes before regulations mandate it.

Trend 2: Europe’s payment modernization reshapes global transactions

Handling multiple payment systems across different regions has long been a challenge for multinational organizations. The European Payments Initiative (EPI) is tackling this issue with ‘Wero,’ a strategic alternative to conventional payment systems.

This initiative is not merely about adding another payment option—it is about establishing Europe’s financial independence, changing how businesses execute transactions in a market of 447 million while adhering to strict data protection laws.

Impact on business operations:

- Process European payments directly, eliminating intermediaries.

- Maintain data in compliance with regulatory requirements.

- Reduce costs by streamlining payment pathways.

- Employ one system for all transactions within Europe.

Strategic priorities:

- Assess the costs associated with your current complicated routing.

- Examine how direct processing in Europe could lead to savings.

- Prepare your systems for upcoming regional payment regulations.

- Plan your transition while others remain content to wait.

We are already witnessing proactive companies restructuring their payment frameworks to embrace this evolution, gearing up for a future where regional payment autonomy becomes the norm.

Trend 3: Enterprise-level payment capabilities become accessible to all

Through our collaboration with businesses of various sizes, we have noticed the technology gap between large enterprises and smaller firms steadily narrowing. Integrated Software Vendors (ISVs) are transforming global workforce payments, making enterprise-level functionalities available to organizations of all sizes.

These all-encompassing solutions go beyond merely streamlining transactions—they are democratizing access to advanced payment technology.

Impact on business operations:

- Leverage the same tools as major corporations, tailored to your scale.

- Automate processes that consume valuable time for your team.

- View all your payments in one interface instead of multiple platforms.

- Expand operations without increasing complexity.

Strategic priorities:

- Identify the limitations of your current tools.

- Look for technology that can scale with your organization.

- Smoothly transition your data to superior systems.

- Empower your team to work more efficiently instead of harder.

Our experiences demonstrate that businesses of all sizes can now handle cross-border payments with the same effectiveness and security that was once exclusive to large enterprises. The barrier to global operations posed by technology is diminishing.

Trend 4: AI Enhances Payment Security and Efficiency

Artificial Intelligence is revolutionizing the way organizations handle payment security and combat fraud. By integrating digital identity verification with immediate transaction assessments, AI establishes a security system that adapts more quickly than emerging threats.

This transition from a reactive to a proactive approach is especially vital for global workforce payments, where conventional systems frequently mislabel genuine international transactions as suspicious.

Impact on Business Operations:

- Eliminate time wasted on unnecessary security alerts.

- Allow AI to identify issues before they escalate.

- Ensure payments continue smoothly while maintaining security.

- Automatically recognize your payment behaviors.

Strategic Priorities:

- Determine where security is currently causing delays.

- Select AI solutions that enhance team productivity.

- Implement systems that adapt to your usual behaviors.

- Create security measures that support, not obstruct.

By integrating advanced AI into our systems, we can analyze numerous data points at once—from location trends to transaction histories—significantly minimizing payment delays while upholding the highest security standards.

Trend 5: Standardizing Payment Data Boosts Global Business Efficiency

The disintegration of payment systems has long posed challenges for international operations. The arrival of ISO 20022 as a common financial language signifies a crucial change in global payments. This is not just another standard; it is the cornerstone for fluid cross-border transactions.

The transition is already in progress: SWIFT’s migration deadline is set for November 2025, the Eurozone has incorporated it for instant payments, and the Federal Reserve’s FedNow Service was launched with ISO 20022 capabilities. By 2026, it is projected that 87% of high-value global payments will utilize this standard.

Impact on Business Operations:

- Communicate in a single language with all your financial institutions.

- Automatically match payments rather than doing it manually.

- Obtain the payment data you truly need.

- Streamline your interactions with various banks.

Strategic Priorities:

- Verify whether your banks are prepared for the transition.

- Plan for utilizing richer payment data.

- Update your systems progressively.

- Ready your team for more straightforward processes.

As this transition progresses, it’s also essential to recognize the increasing influence of cryptocurrencies in shaping the future of global payments. With growing regulatory scrutiny—especially with the new administration in the US—cryptocurrencies are likely to play a more significant role in the payment ecosystem.

The merging of traditional payment standards like ISO 20022 with innovative technologies such as crypto could result in additional efficiencies in cross-border transactions, offering businesses broader options and further streamlining international operations.

Expect Payments Disruption In 2025

The payments landscape has undergone significant changes in recent years: Between 2020 and 2022, the COVID-19 pandemic brought both chaos and innovation. In 2023, we focused on consolidating after that wave of innovation. The year 2024 was about differentiating our businesses from competitors amidst all that change by utilizing payment technology to enhance the value of the payment itself.

What can we anticipate for 2025? Expect more ups and downs, along with major disruptions to the existing system:

Geopolitical conflicts and wars will increase the movement of payments through alternative channels

Following Russia’s invasion of Ukraine, Visa and Mastercard removed all Russian transactions from their networks, prompting Russian financial institutions to transition domestic payments to the Mir payment system. Significant B2B transactions, including oil trades, are already utilizing alternative payment channels like China’s CIPS and Russia’s SPFS in response to sanctions against major oil-exporting nations. With rising geopolitical tensions and nationalism in the future, governments are likely to shift a greater volume of payments away from global networks toward their local systems to lessen international dependencies and scrutiny. Global payment firms and banks will face a choice: whether to back local payment channels and diversify their offerings, which could lead to sanctions, or to concentrate on their core markets.

Globally, cash usage will decline by 40%, as UPI and Pix become more widespread

The year 2025 will represent a pivotal moment for markets where cash has maintained a strong presence. By 2025, account-to-account and real-time payments will replace cash in Europe and Latin America, particularly in nations with younger demographics receptive to non-cash options. The launch of India’s Unified Payments Interface (UPI) in Peru will trigger a chain reaction throughout the region, along with a wave of subsequent innovations. While certain areas of the US are becoming cashless, the overall struggle to eliminate cash reliance among the unbanked and underbanked populations will impede progress.

The sector of B2B payments will see a surge in mergers and acquisitions, spurred by interest rate reductions and funding availability

We anticipate that at least a dozen significant firms will acquire smaller B2B payments companies in 2025. The benefit: Business clients will enjoy more coordinated and streamlined B2B payments solutions in the marketplace. Competition within B2B payments will heighten: for instance, providers of accounts payable invoice automation like Basware, Coupa, and Esker are quickly expanding into B2B payments while pursuing acquisitions. The implication: If they act swiftly, larger companies may uncover acquisition opportunities that enhance their B2B payments functions.

One-click checkout will prove challenging for one in five merchants, raising their costs by 30%

Surprisingly, we foresee that consumers will face increased frustration with the resurgence of one-click checkout (1CC) alternatives. The reason? 1CC options are diverse and compete with numerous other systems aiming to autofill data and streamline checkout processes. Consumers often won’t have accurate data updated across all the various platforms they encounter during checkout and may mistakenly place orders with incorrect autofilled details — or even finalize orders before they intend to. Consequently, as they seek to correct these checkout optimization attempts that have gone awry, merchants will face increased expenses related to customer service and shipping logistics.

Payments in 2025 will be influenced by AI, immediate payment options, CBDCs, integrated finance, and sustainability efforts

The payments sector in 2024 experienced swift changes, characterized by the increasing use of real-time payments, advancements in AI-powered fraud detection, and notable developments in Central Bank Digital Currencies (CBDCs). These advancements have paved the way for an even more vibrant year ahead as technology continues to alter the dynamics of business and consumer payment interactions.

With competition growing and regulatory environments evolving, it is more important than ever to stay informed about emerging trends. Anticipating what lies ahead in 2025 will aid payments professionals in recognizing changes, capitalizing on opportunities, and addressing challenges in a rapidly changing landscape.

Companies are focusing on creating smoother, more user-friendly payment transactions to fulfill consumer expectations. Masha Cilliers, Founder and Principal Consultant at Payments Options, points out that the emphasis in 2025 will be on minimizing friction in payment experiences and ensuring they cater to distinct customer preferences.

“The businesses that fuel our economy are undergoing a transformation in how they utilize technology to engage with and better serve their clients. Payment technologies are increasingly becoming central to business operations, and mastering them is vital for organizations of all sizes,” stated Cameron Bready, CEO of Global Payments. “Our 2025 report examines everything from the revolutionary potential of AI and biometrics to the technological demands of social commerce. The insights presented in this report highlight Global Payments’ dedication to grasping the trends that impact global commerce and to continue driving innovation for our clients.”

The report pinpointed six significant developments that are redefining the rules of commerce and presents a comprehensive overview of how small and midmarket businesses as well as larger enterprises are recognizing the strategic value of the payments experience and associated technologies. The six trends are:

AI achieves initial successes – AI has transitioned from a conceptual game-changer to an actual impact-maker. Generative AI is revolutionizing client services and marketing, while AI consistently demonstrates its significance in key areas such as fraud prevention. Despite enterprises showing some hesitance due to concerns like data privacy, small and medium-sized businesses are more optimistic about the potential applications of AI.

Integrating commerce backend operations – As consumers increasingly shop online, businesses are consolidating their backend operations into unified platforms that provide seamless experiences no matter where customers begin or complete their purchasing journey. According to Global Payments’ survey, a higher percentage of SMBs (67%) and midmarket firms (71%) plan to enhance or significantly increase their investments in unified commerce platforms compared to larger enterprises.

Embedded payments expand in B2B contexts – The aspects that have made embedded payments appealing for consumers are proving to be equally compelling in B2B settings, facilitating the incorporation of B2B transactions within business processes and supply chain operations. At the same time, the rise of embedded finance in consumer environments is assured.

New solutions enhance digital security and combat fraud – The escalating complexity of identity theft, fraudulent activities, and AI-driven fraud is prompting organizations throughout the payments ecosystem to seek biometrics, tokenization, and other advanced security techniques. These enhancements are also yielding improved experiences for consumers and operational benefits for businesses.

POS evolving into a Place of Service – More frequently, merchants have the ability to create loyalty programs, craft email marketing initiatives, and personalize their ordering systems within a single POS package. When augmented with AI, POS systems will transform into proactive partners that assist in managing a business. Consider it as the “Place of Service,” where the POS system influences all other customer journey touchpoints.

Advancements in payment orchestration – While payment orchestration technologies are not new, their significance continues to escalate as companies concentrate on operational efficiency. Surveyed leaders cited advantages such as enhanced customer experience, improved accessibility, increased security, fraud prevention, and operational efficiency.