The price of Bitcoin reaching an impressive $100,000 has kept the focus on the exciting realm of cryptocurrencies.

However, grasping complex terms like ETFs, blockchains, and cold wallets that might come up in discussions with crypto fans and casual investors can be challenging.

Don’t worry.

If you’re encountering these terms for the first time or simply need a refresher, here are some essential words explained.

Bitcoin

While many may find the intricate details of crypto confusing, nearly everyone is familiar with its most renowned form: Bitcoin. But what is it exactly?

Bitcoin is a form of cryptocurrency, which essentially means it’s a variety of digital currency. Unlike conventional currencies—such as the dollar or pound—Bitcoin isn’t regulated by centralized financial entities. This allure of decentralization appeals to those who believe it can provide financial independence, but it also contributes to its extreme volatility, as its value is subject to rapid fluctuations based on market activity from buyers and sellers.

Its value surged in 2024, especially in November after Donald Trump’s victory in the US elections. On December 5th, Bitcoin’s value surpassed $100,000—an achievement investors have eagerly anticipated.

However, Bitcoin’s value has a history of dropping just as swiftly as it increases.

Bitcoin ‘halving’

The blockchain, which serves as the foundation for Bitcoin, is maintained by rewarding “miners” who are responsible for validating transactions with cryptocurrency.

Yet, unlike some other digital currencies, Bitcoin has a finite supply. The total number of bitcoins that can be mined is limited to 21 million, and most of these are already available in the market.

Approximately every four years—or when the Bitcoin blockchain reaches a defined size—the number of bitcoins that miners receive as a reward for successful transaction validation is halved. The latest Bitcoin “halving” (or “halvening”) occurred on April 20, 2024, cutting the reward for miners from 6.25 bitcoins to 3.125.

This mechanism prolongs the availability of Bitcoin while, theoretically, increasing demand over time. However, with reduced rewards for miners, it raises questions about whether their resource-intensive operations remain financially viable.

Blockchain

Blockchain is the underlying technology for all cryptocurrencies, as well as many related products such as non-fungible tokens (NFTs). Essentially, it functions like a digital ledger where all transactions involving cryptocurrency are documented. Transactions are grouped in blocks linked together in a large chain—hence the name.

Each cryptocurrency transaction is logged onto the blockchain by a vast network of volunteers who confirm its authenticity using computer programs.

The incentive for individuals participating in Bitcoin’s network is that the first one to validate transactions receives a reward in Bitcoin. This potentially profitable process, known as mining, is controversial because of the enormous energy consumption involved as competitors worldwide vie to be the first to update the blockchain successfully.

Crypto Exchange

A crypto exchange is an online platform where investors can purchase, sell, and trade cryptocurrencies. Similar to conventional investment platforms, a crypto exchange acts as a brokerage, allowing users to convert fiat currencies, like pounds or dollars, into cryptocurrencies such as Bitcoin or Ethereum. Most transactions incur fees.

Crypto Wallet

A crypto wallet is where investors keep their cryptocurrencies. It functions to hold virtual assets, mimicking how a physical wallet accommodates cash. There are two types: a hot wallet and a cold wallet. Hot wallets are internet-connected, facilitating quick transfers and easy access. Cold wallets are tangible devices, such as specialized USB drives, that store cryptocurrency offline and are typically used for secure long-term holding.

Ethereum

Ethereum refers to both the second-largest cryptocurrency after Bitcoin, represented by the Ether token, and the blockchain that supports it. This platform facilitates various applications and digital assets, including non-fungible tokens.

It operates similarly to Bitcoin and other cryptocurrencies but transitioned in 2022 to a more eco-friendly model that requires less computational power and energy.

What are NFTs and why are some worth millions?

Exchange-traded funds (ETFs)

ETFs are investment portfolios that allow investors to speculate on multiple assets without needing to purchase any directly. These funds are traded on stock exchanges like shares, and their value fluctuates based on the overall portfolio’s performance in real-time. They can consist of a mix of assets, such as gold and silver bullion, or shares in both technology and insurance firms.

A spot Bitcoin ETF directly purchases the cryptocurrency “on the spot,” at its current price, throughout the trading day. While previous ETFs have included Bitcoin indirectly, the US approved several spot Bitcoin ETFs in January 2024, enabling new investors like asset management firms such as Blackrock and Fidelity to enter the speculative Bitcoin market without having to own the cryptocurrency directly.

Stablecoins

The term “stable” is crucial here – this type of cryptocurrency aims to have a less volatile value.

This generally operates by tying its price to an existing asset, such as currencies like the US dollar or Pound Sterling, which theoretically should make them less prone to price fluctuations compared to cryptocurrencies that lack backing by assets.

Stablecoins are predominantly managed by companies that issue them, with transactions recorded on digital ledgers. While some advocate for them as the future of finance, high-profile collapses in stablecoin prices have raised concerns among regulators regarding risks for investors and brought attention to their claimed stability.

XRP

XRP is a cryptocurrency utilized by a platform called the XRP Ledger. Created by the co-founders of Ripple Labs in 2012, it was designed as a cost-effective, faster alternative to Bitcoin.

The cryptocurrency has a predetermined supply of 100 billion coins, which were generated at its inception. A substantial portion of it is held by Ripple and released into circulation periodically.

Unlike cryptocurrencies like Bitcoin, XRP transactions are verified via consensus—wherein the majority of validators on its peer-to-peer network must concur on the validity of a transaction before it gets added to its blockchain.

This consensus mechanism has been credited with enabling many transactions to occur simultaneously at high speed and low cost, making it attractive to financial institutions and for activities like cross-border payments. However, similar to other cryptocurrencies, XRP has faced regulatory scrutiny and experienced sudden, sharp declines in value.

The price of Bitcoin is nearing its all-time peak, significantly due to investments from major US financial firms.

Investment companies such as Grayscale, BlackRock, and Fidelity are investing billions into acquiring this volatile digital asset.

Recently, these influential institutions have become known as ‘Bitcoin whales.’

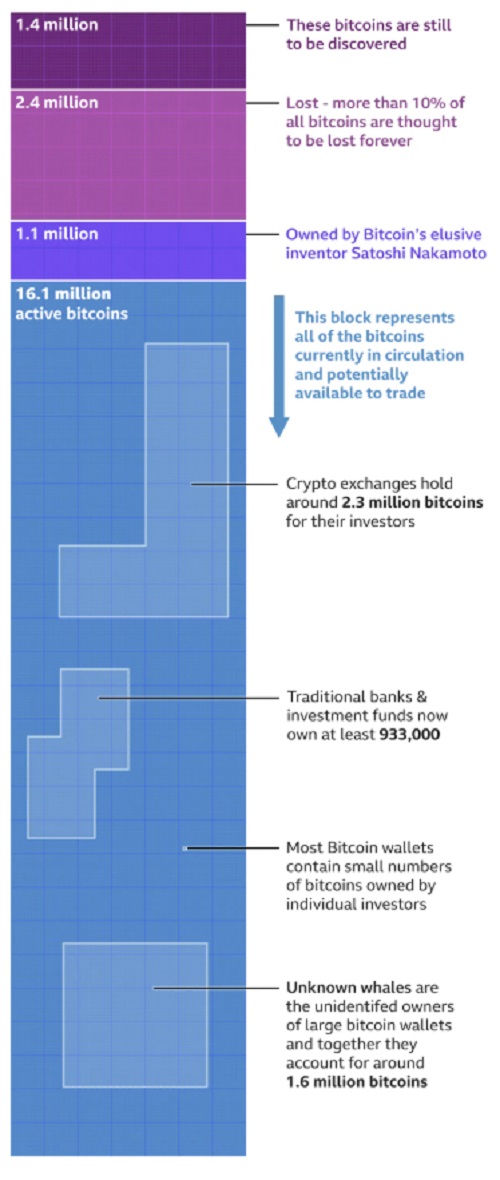

Due to Bitcoin’s protocol, there will ultimately be a maximum of 21 million bitcoins.

Nineteen million have already been created, but many are accounted for and likely removed from circulation.

So, who else qualifies as Bitcoin whales, and what implications does this wealth shift hold for the digital currency originally envisioned as peer-to-peer internet money?

The following figures are estimates based on direct research and published data, but they should provide a general understanding of Bitcoin distribution. Our data collection concluded on the morning of February 29.

21 million bitcoins

Lost bitcoins

Estimates on the number of bitcoins permanently lost range from three million to as many as six million. Bitcoins can be rendered lost when individuals forget their digital wallet credentials—there’s no ‘customer support’ available in Bitcoin. Just ask James Howells, who misplaced 8,000 bitcoins on a discarded hard drive in Wales.

Some of these lost bitcoins may also stem from abandoned criminal gains left untouched. According to crypto-investigators at Elliptic, approximately 3.15 million bitcoins have been inactive for a decade or more. Certain analysts, including those from Chainalysis, suggest that bitcoins which haven’t been moved in five years might also be considered lost. Therefore, millions more could likely add to the lost count.

A commonly accepted rough estimate is about 3.5 million. However, 1.1 million of these dormant bitcoins are believed to belong to the anonymous founder of Bitcoin, so we can exclude that portion from our calculations. Consequently, a conservative assessment for lost bitcoins would be roughly 2.4 million, equating to 11% of the total bitcoins.

Cryptocurrency exchanges

Cryptocurrency exchanges function similarly to banks for crypto users. They enable the exchange of traditional currencies like dollars or pounds for Bitcoin and other digital assets. K33 researchers estimate that roughly 2.3 million bitcoins are held by exchanges, either in customer accounts or as operational float. Binance is the largest exchange globally, estimated to possess about 550,000 bitcoins, followed by Bitfinex (403,000), Coinbase (386,000), Robinhood (146,000), and OKX (126,000). It is thought that exchanges collectively hold around 11% of all bitcoins.

However, keeping your coins on an exchange can present risks, as illustrated by the collapse of FTX, which left clients without access to their holdings. Additionally, some Bitcoin enthusiasts are concerned that reliance on large, increasingly regulated exchanges contradicts the anti-establishment philosophy of Bitcoin.

Unknown whales

A Bitcoin whale is defined as someone with over 10,000 bitcoins in their digital wallet. The website Bitinfocharts utilizes public blockchain records to maintain a Bitcoin Rich List of the 100 wealthiest wallets, with approximately 80 wallets containing 10,000 coins or more, whose owners remain unidentified. Owning one of these wallets would qualify you as a billionaire. Some of these wallets may belong to individuals or organizations identified elsewhere in this analysis, but unless a connection is established by researchers or the owners disclose themselves, we may never know. A rough estimate suggests that large whales account for approximately 8% of all bitcoins.

Yet to be mined

Bitcoin was created in a way that limits its total supply to 21 million coins. Each coin must be mined through a network of volunteer computers located across the globe. These computers, often operated by substantial Bitcoin mining enterprises, function as advanced accountants verifying and safeguarding Bitcoin transaction records. In exchange for their efforts, these computers receive Bitcoins as automatic rewards.

Over time, the distribution of coins offered as mining rewards is systematically decreased, and it will undergo another reduction in April, further tightening the supply of new coins. Approximately 7% of coins remain to be mined, with projections suggesting that the last Bitcoin will be produced in the year 2140.

Satoshi Nakamoto, the creator of Bitcoin

The anonymous inventor of Bitcoin is estimated to possess around 1.1 million bitcoins in wallets established in 2009. None of these coins have been moved for years, and the identity of Satoshi remains unknown—there’s even uncertainty regarding their current status. If they are indeed alive and these estimates hold true, Satoshi Nakamoto would rank as the 22nd richest individual globally, holding about 5% of all bitcoins.

Regulated investment firms

In January, US regulators permitted investment firms under regulation to begin offering new financial products tied to Bitcoin, known as Spot Bitcoin ETFs. By mid-February, the major investment firms that applied for ETFs started acquiring thousands of bitcoins, as investment entities ranging from hedge funds to stock market investors purchased ETFs to speculate on Bitcoin’s price without needing to possess any coins directly.

K33 Research reports that as of February 29, 933,000 coins had been earmarked or obtained by 29 institutions for these new financial products. Analysts from K33 suggest that Grayscale, originally a digital currency investment firm, is likely the largest holder with an estimated 450,000 bitcoins. Other significant players include BlackRock with about 150,000 bitcoins and Fidelity holding around 102,000.

Many cryptocurrency enthusiasts online are celebrating the increase in their net worth due to the financial sector boosting Bitcoin’s price through higher demand. However, some have raised concerns about the accumulation of power and wealth within the conventional regulated banking system, which Bitcoin was designed to counteract. These financial behemoths now control roughly 4.5% of all bitcoins. One wonders how Satoshi Nakamoto might react if traditional banks surpass their holdings of bitcoins.

Law enforcement

Police departments globally frequently dismantle cyber-crime syndicates or illegal marketplaces, confiscating vast amounts of bitcoins during their operations. Since 2020, the US has conducted three notable Bitcoin seizures. Ultimately, these bitcoins will be auctioned off, but according to research by 21.co, the assets have remained in their respective crypto-wallets untransferred, amounting to nearly 200,000 bitcoins from these actions. Arkham Intelligence also linked another wallet containing 30,000 bitcoins to the US seizure linked to the Silk Road darknet marketplace. The UK is believed to retain 61,000 bitcoins from a significant seizure in 2018, while it is estimated that German authorities hold an additional 50,000 coins from a recent crackdown.

MicroStrategy, a software company

Bitcoin supporters are often portrayed with laser eyes in their social media images, and none shine brighter than those of entrepreneur Michael Saylor. In 2020, he convinced his software company to begin acquiring as much Bitcoin as possible, celebrating every acquisition with a tweet that typically becomes viral among cryptocurrency supporters. MicroStrategy, along with its subsidiaries, now possesses roughly 193,000 bitcoins, making it the largest single organizational holder of these digital coins.

Block One, a crypto-software company

In 2020, the CEO of Block One, a crypto-software company, stated in a tweet that his organization had continued to buy bitcoins following an initial acquisition of 140,000. Thus, the actual total is likely much larger. The firm has not responded to our inquiry.

Mt Gox, coins lost in the hack

Amid a series of disastrous hacks and incidents, Mt Gox, the first significant crypto-exchange, lost approximately 850,000 bitcoins in 2011. Mark Hunter, who authored a book about the incident, mentions that confusion persists regarding the fate of these coins, but it is generally assumed that most were resold into the open market by the perpetrators.

Nevertheless, 80,000 bitcoins remain untouched in a well-known crypto-wallet address starting with ‘1Feex’. This collection will likely never be retrieved or transferred. Additionally, 2,600 bitcoins were accidentally and irreversibly lost during the chaos. Some customers who lost their investments due to the hacks have begun to receive a portion of their losses back from recovered coins.

People

A rough estimate of the total number of bitcoins owned by the general public is approximately 10.5 million. This accounts for about 50% of all bitcoins currently in existence, after excluding the known large holdings. This figure may increase when considering the bitcoins held by exchanges, as many of these belong to individuals as well. However, it could also decrease if there are more lost coins than anticipated or if bitcoin whales possess a greater quantity than we realize.

The exact number of individual bitcoin owners remains uncertain, but crypto technology firm River projected that as of June 2023, Bitcoin had around 81.7 million users, representing 1% of the world’s population. Notably, studies indicate that the recent increase in Bitcoin’s value is not driven by individual retail investors purchasing bitcoins. Analysts from IntoTheBlock have found that large investors, often referred to as bitcoin whales, including major banks, are the primary contributors to the rising prices and demand, rather than a surge in interest from everyday people in this peer-to-peer digital currency.